Relationship Associate Resume Samples

4.5

(120 votes) for

Relationship Associate Resume Samples

The Guide To Resume Tailoring

Guide the recruiter to the conclusion that you are the best candidate for the relationship associate job. It’s actually very simple. Tailor your resume by picking relevant responsibilities from the examples below and then add your accomplishments. This way, you can position yourself in the best way to get hired.

Craft your perfect resume by picking job responsibilities written by professional recruiters

Pick from the thousands of curated job responsibilities used by the leading companies

Tailor your resume & cover letter with wording that best fits for each job you apply

Resume Builder

Create a Resume in Minutes with Professional Resume Templates

CHOOSE THE BEST TEMPLATE

- Choose from 15 Leading Templates. No need to think about design details.

USE PRE-WRITTEN BULLET POINTS

- Select from thousands of pre-written bullet points.

SAVE YOUR DOCUMENTS IN PDF FILES

- Instantly download in PDF format or share a custom link.

HS

H Schowalter

Hassie

Schowalter

9261 Nicholaus Cliff

Houston

TX

+1 (555) 852 0315

9261 Nicholaus Cliff

Houston

TX

Phone

p

+1 (555) 852 0315

Experience

Experience

Chicago, IL

Relationship Associate

Chicago, IL

Trantow Inc

Chicago, IL

Relationship Associate

- Monitor credit allocation throughout the network working with product partners, subsidiary account manager, bankers and credit risk

- Work closely with RAMs on AML issues and provide on-going assistance with monitoring of Cash and unusual transactions

- Work closely with RAMs on AML issues and provide ongoing assistance with monitoring the Cash and unusual transactions

- Develop internal and external referral networks through existing client base, referral sources and community business development activities

- Assist with excellence in execution by working closely with Coverage, Client Delivery and Documentation to remove blockages and provide prompt query resolution

- Flexibility with work schedule (i.e. may work across different time zones)

- Assisting his/her Relationship Manager with client on-boarding

Boston, MA

Ccb-relationship Associate

Boston, MA

Marks Group

Boston, MA

Ccb-relationship Associate

- Partnering with the Relationship Managers and Product Sales Managers to boost cross-sell and drive increase in share of wallet

- Providing clients with customized solutions/services to manage their businesses with greater efficiency

- Proactively manage a portfolio of CCB Client relationships

- Analytical and meticulous towards works

- Client Onboarding – Own the end-to-end onboarding process for new client accounts and credit facility set-up from documentation to implementation

- Client Onboarding - Own the end-to-end onboarding process for new client accounts and credit facility set up from documentation to implementation

- Effectively handling designated credit and KYC responsibilities

present

Los Angeles, CA

Bilingual Relationship Associate

Los Angeles, CA

Jakubowski and Sons

present

Los Angeles, CA

Bilingual Relationship Associate

present

- Assist Relationship Managers (RM) in the daily management of client’s requests, including but not limited to relationship reviews, managing account opening process, customer due diligence, and credit reviews

- Support RM to achieve revenue goal and pursuing of new business opportunities

- Become an active and trusted team member in front of the client as part of the Relationship Team

- Be a partner with RM to ensure client’s satisfaction

- Assist in the preparation of materials for presentations and aid in research client and industry news in advance

- Support in the preparation of Relationship Reviews and Account Analysis

- Assist clients and RM with completeness of account documentation and Service Agreements

Education

Education

Bachelor’s Degree in Accuracy

Bachelor’s Degree in Accuracy

Ohio University

Bachelor’s Degree in Accuracy

Skills

Skills

- Ability to practice good judgment while making basic business decisions

- Trust Administration background and knowledge or ability to review and interpret trust language favorable

- Strong understanding and basic knowledge of competitors

- Basic to strong credit skills

- Detail-oriented with the ability to multitask and meet deadlines

- Excellent customer relation skills focused on delivering superior service quality

- Interpersonal skills/networking: Able to create and sustain good personal contacts within the team, amongst Citi’s product partners and external clients

- Strong prioritization and multi-tasking skills. Able to function effectively in an unstructured environment and remain objective under pressure

- Interpersonal skills&networking; ability to create and sustain good personal contacts within the team and with the product partners

- Excellent verbal and written communication both in Czech and English; ability to communicate effectively across the organization

15 Relationship Associate resume templates

Read our complete resume writing guides

1

Relationship Associate Resume Examples & Samples

- Serve as point of contact for clients (or prospects) and independently manage all follow-up and/or ongoing deliverables. Communicate and coordinate with other areas within FTCI (Legal, Marketing, Business Development, Operations, Estate Administration, Compliance, Strategic Advisory Group, etc) in an effort to meet all client deliverables. The Relationship Associate will ensure that all areas of expertise within FTCI are leveraged as necessary to best service client

- Handle client requests and process wire transfers, discretionary principal payments, currency transactions, bill paying, deliveries/receives and gifts & contributions

- Works with the Relationships Managers, Portfolio Managers and Trust Officers on large and complex family relationships and prospects through the following: administration of accounts, preparation of cash flows, fee reviews, preparation of account summaries, preparation of customized PowerPoint presentations for use in client meetings, etc

- Partner and collaborate with the Relationship Managers, Portfolio Managers and Trust Officers to understand and identify client goals and objectives, both short-term and long-term. This may entail attending client meetings with the Relationship Manager, Portfolio Manager or Trust Officer and participating in discussions about client needs/goals, their circumstances, and making an effort to better understand the clients’ extended family and younger generations. The Relationship Associate should be able to prioritize the client needs/goals within the framework of the FTCI business objectives while developing solutions to meet their needs/goals

- Review overdraft report to determine how to cure income overdrafts. Coordinate with PM to raise cash to cure principal overdrafts

- Responsible for various office management tasks including: calendar management, client meeting coordination, procurement, filing expense reports, etc

- Undergraduate degree required, or equivalent experience

- Detail-oriented with the ability to multi-task in a fast paced environment

- Effectively handle various projects and be able to prioritize tasks to meet requested deadlines

- A strong interest and desire to learn about trust and estates planning, wealth management and Investment Advisory laws/issues/topics

- Strong interpersonal and communication (both written and verbal) skills with the ability to interact with clients and build new client relationships

- Strong analytical skills with the ability to think strategically as it relates to client needs

- Proficiency with Microsoft Word, Excel & PowerPoint

- JD desired, but not required

2

Ishares Institutional Relationship Associate Resume Examples & Samples

- Drive Net New Business, executing a consultative sales approach

- As a member of the team, a BDA will actively participate in the business management and territory planning with the Business Development Officer (BDO)

- Successfully use the telephone identify new opportunities and pursue existing ones; client profiling, lead identification, follow-up activity, setting up meetings, and sales execution

- Ability to study and comprehend various whitepapers and other readings to master the fundamentals of fixed income ETF structure and trading behavior

- High level of client interaction with a consultative sales approach

- Ability to present quantitative (analytical) and qualitative benefits of ETF investing, as well delineate the unique iShares value proposition

- Use creative thinking to target clients and to develop customized sales strategies

- Exceed the minimum activity standards

- Develop and leverage key internal relationships to aid in providing solutions to insurance balance sheet portfolio managers, investment analysts, asset management product managers and trading desks

- In particular, be able to leverage FIG, FIG PM, capital markets, product consulting, fixed income strategy, data team, compliance and other senior iShares sales leaders for client meeting follow-up and new prospect procurement

- Manage day-to-day operational duties (manage and track sales lead flow, manage and maintain CRM database, report weekly activities and accomplishments, respond to daily client data requests, etc.)

- BA/BS degree required

- 5+ years of experience in mutual fund or brokerage industry; some insurance industry (general account and variable annuity) knowledge would be preferable

- NASD Series 7 and 66 (or 63 & 65) required

- Ability to develop relationships with insurers and insurance asset managers and position investment ideas and other value-add services generating sales and assets

- High energy, motivated individual, committed to excellence

- Strong phone selling skills

- Solid presentation skills both on the phone and in-person

- Solid MS Office skills, including: Word, Excel, and Outlook. Experience with web-based CRM solutions

- Experience with Bloomberg

- Strong character references

- Clean U-4

3

FIG Relationship Associate Resume Examples & Samples

- Execute FIG’s sales strategy, focusing on solutions oriented-new business development

- Understand fully the array of solutions BlackRock has to offer insurers and lead client-focused discussions on these solutions

- Develop new client relationships

- Manage a portfolio of existing client relationships

- Develop and maintain competitive intelligence and senior business contacts in the insurance industry

- Interface with client’s C-suite stakeholders, engaging the support of BlackRock’s senior management for assistance

- Mentor, coach, and provide leadership to peers

- 3+ years of relevant industry experience with a proven track record of driving business results

- Must be able to demonstrate prior experience designing and executing a business plan and strategy

- Experience in a management consulting or strategic sales role preferred

- Strong communication skills – ability to communicate complex or new ideas in a clear articulate manner both in written work and presentations to large and small audiences

- 40% of travel is required

4

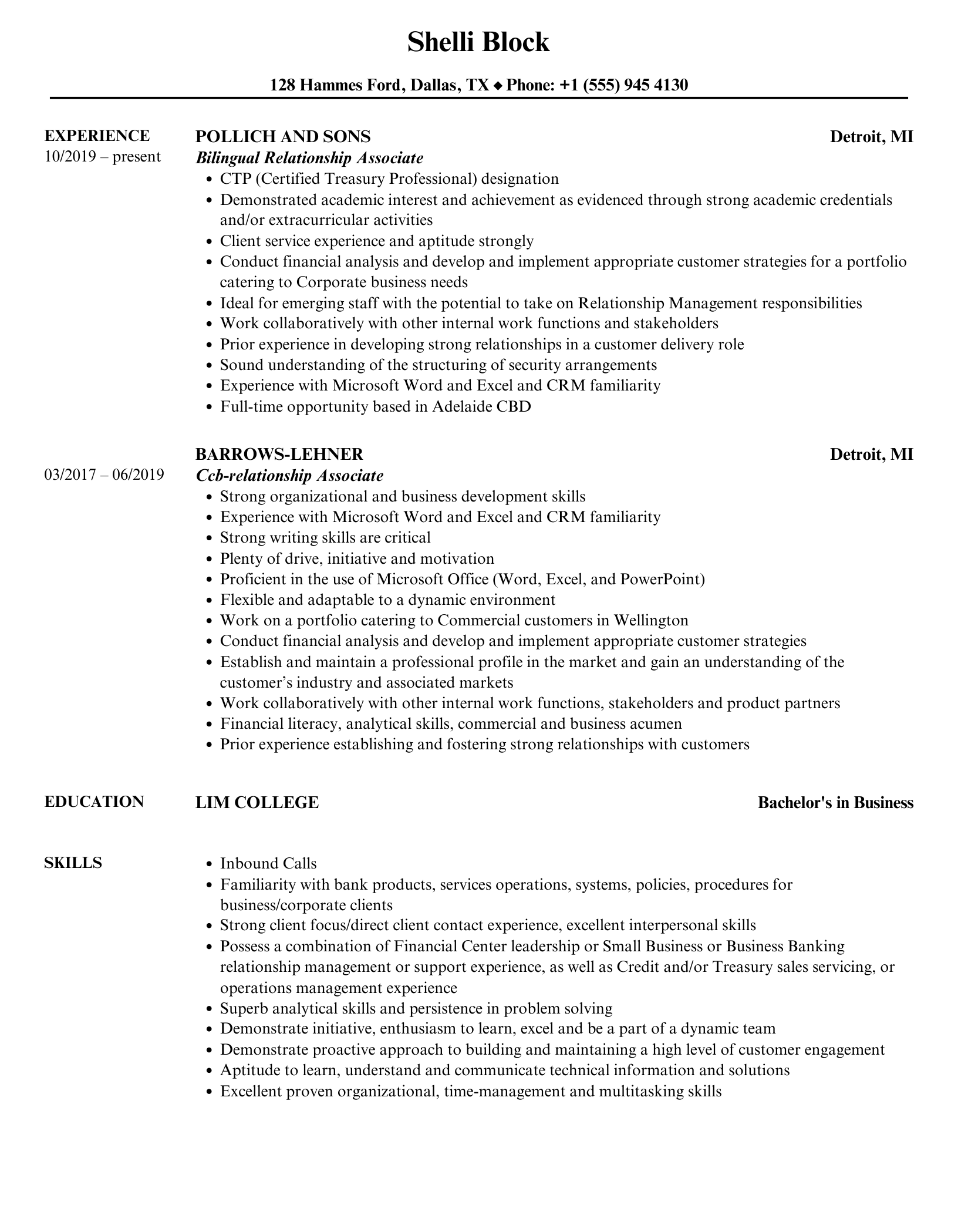

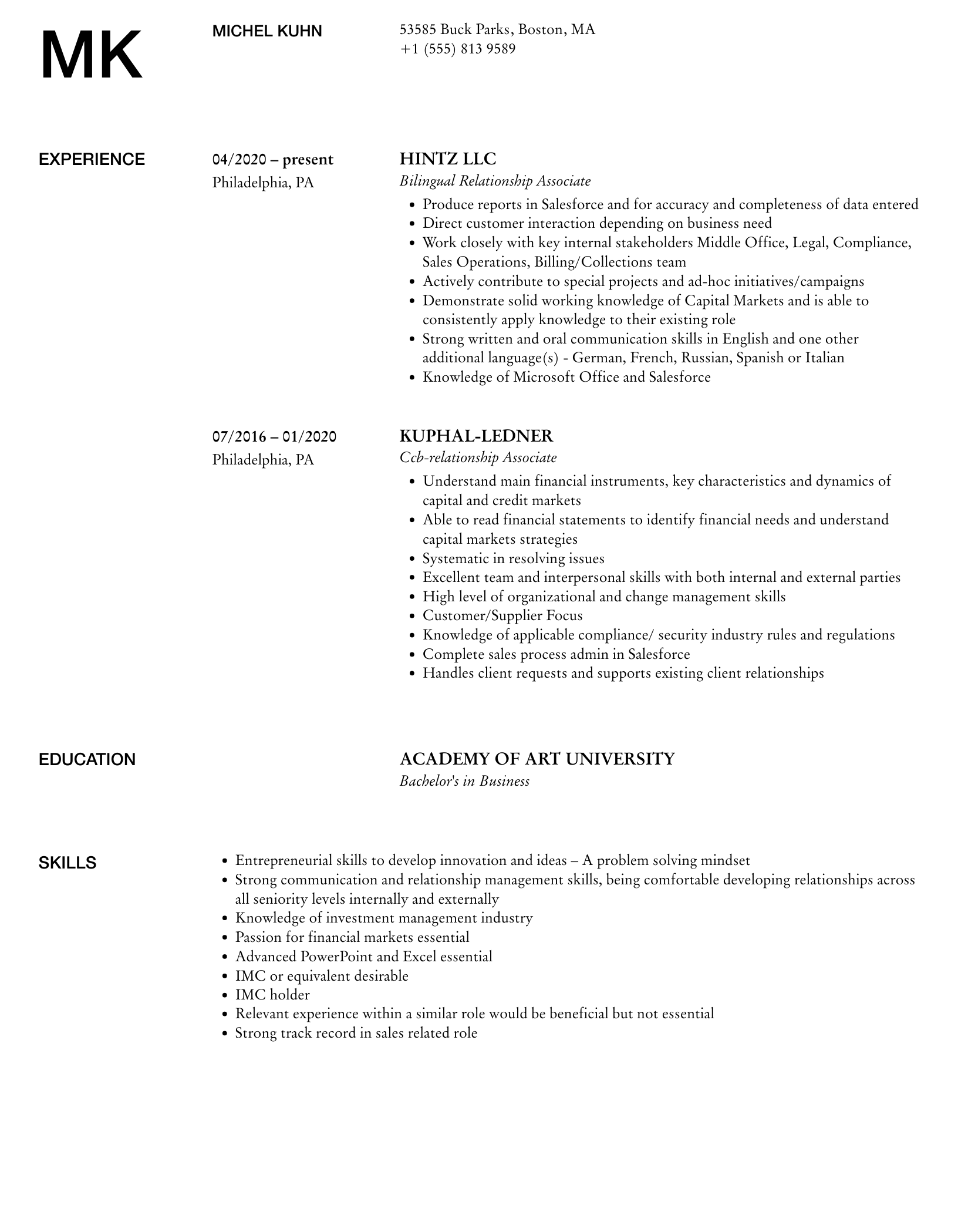

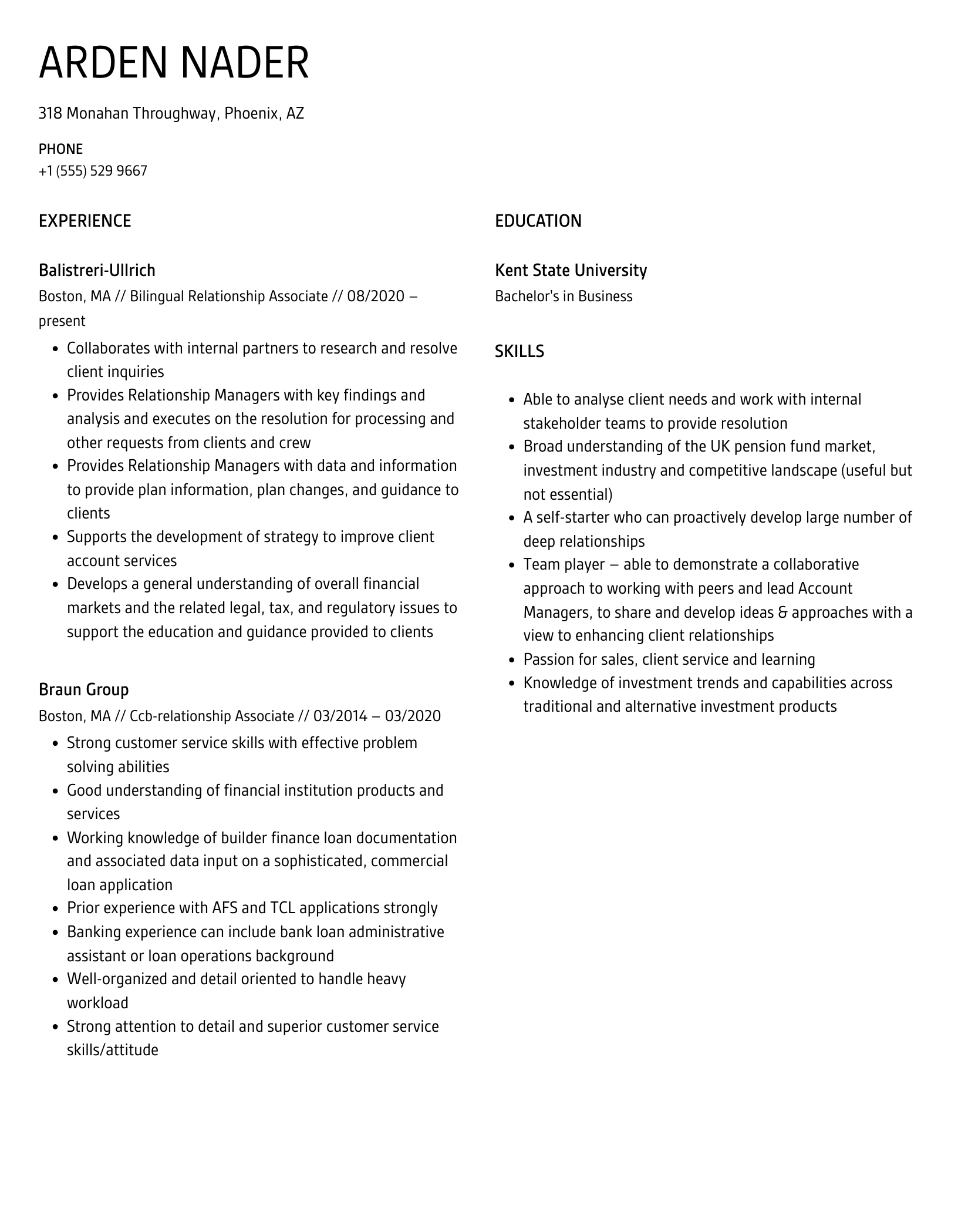

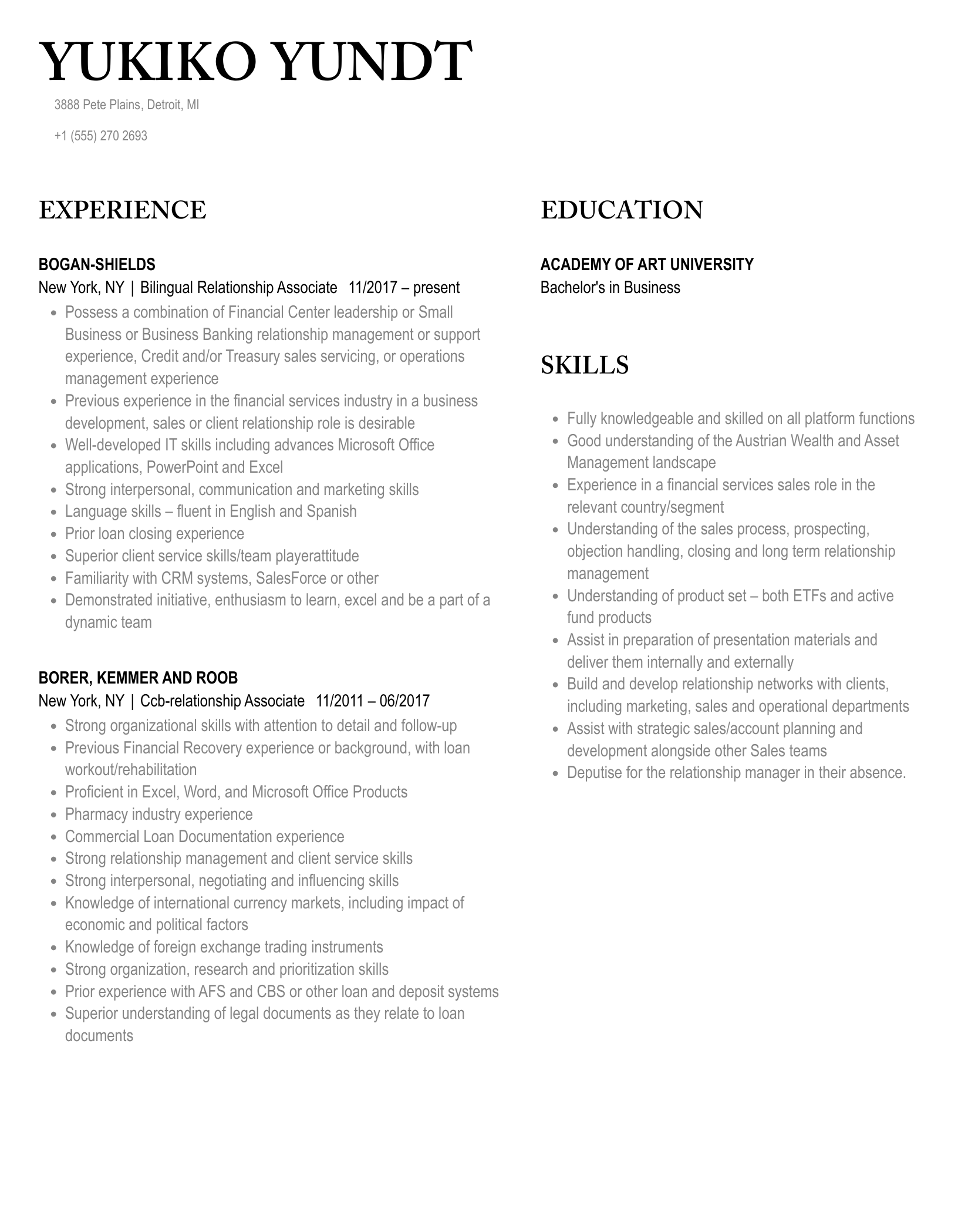

Bilingual Relationship Associate Resume Examples & Samples

- Assist Relationship Managers (RM) in the daily management of client’s requests, including but not limited to relationship reviews, managing account opening process, customer due diligence, and credit reviews

- Support RM to achieve revenue goal and pursuing of new business opportunities

- Become an active and trusted team member in front of the client as part of the Relationship Team

- Be a partner with RM to ensure client’s satisfaction

- Support in the management of Business as Usual (BAU) clients to ensure client’s needs and requests are covered on a timely basis

- Assist in the preparation of materials for presentations and aid in research client and industry news in advance

- Participate in client visits as required

- Support in the preparation of Relationship Reviews and Account Analysis

- Support with cross-sell opportunities by preparing proposals as per client’s needs

- Assist clients and RM with completeness of account documentation and Service Agreements

- Assist with Fee Schedule preparation for clients and prospects

- Account opening process and related administrative matters including review with legal of ownership and other account opening documentation; request of Base and Account numbers, GFCID request in AMC, CADD request, and completion of Account Opening Checklist

- Responsible of harmonization of client hierarchy and domicile country in CIS. Coordinate with Financial Control to ensure usage of correct cost center and client hierarchy and with Documentation Unit during the flow of account opening for new and existing clients. Ensure following account opening protocols for ICG and GSG

- Support in the Credit Review Process by providing assistance with the completion of Exhibits for Credit Annual Reviews, ACH memo locally approved and Extending Unit Due Diligence (EUDD) Reviews. Including Documentation Checklist, Return on Risk Capital (RORC) or Dashboard, CA Face and Back Pages, Anti-Tying, Franchise-Risk and Early Warning

- Support in the request of new credit lines for approved elsewhere and ACH facilities

- Support with the documentation update for credit and regulatory purposes including Financial Statements, Certificate of insurance and flood, Promissory Note, Grid Note, etc

- Ensure Covenants Checklist monitoring as per client’s Credit Agreement requirement

- Assist in daily overdraft approval process and monthly overdraft charges

- Monitoring of ACH and wire transfer approvals by RM, Credit Officers and Risk to get approval

- Support with completeness of client’s deferral Documentation

- Support with real estate clients’ certifications and releases

- Support during deal closings

- Responsible to process transactions in eDealer

- Assist in the collection effort of past due invoices

- Provide support with fees monitoring and collections

- Effectively manage communication between the Citi’s operational areas, customer service, legal, and compliance to address client related needs including documentation reviews, confirmations, and investigations, pricing discrepancies, investigations and escalated service concerns

- Effectively manage communication with Directs Reports to coordinate priorities and escalation of client related matters. Follow up on escalated service issues or client requests to ensure resolution and communication with the client

- Other responsibilities related to client management and relationship support can be assigned as required during the course of business

- Bachelor's Degree in Finance or Accounting

- Candidate must have 2 years of experience in Finance, Accounting or Banking

- Excellent verbal communication and writing skills in English and Spanish

- Quality and Service oriented Team Player Able to work under pressure

- Ability to maintain professional relationships with top management

- Flexibility work longer hours

- Candidate must feel comfortable in navigating in multiple systems/applications

5

Relationship Associate, CB, TMT Resume Examples & Samples

- Serve as the primary contact for all global transactional banking issues by interacting with treasurers, assistant treasurers, and other treasury personnel from an assigned portfolio of clients and navigating through Citi's extensive network of 100+ countries including providing local relationship manager introductions as needed

- Monitor credit allocation throughout the network working with product partners, subsidiary account manager, bankers and credit risk

- For CADDs, monitor their progress and renewal through the ECADD system

- Work with Analyst and Associates in preparing spreadsheets for periodic support discussions and coordinate the related meeting or call

- May support bankers in coordinating relationship reviews or participate in the annual client reviews

- Moderate credit skills/experience (e.g. financial accounting, commercial lending theories, industry awareness, loan structuring, etc.) but with good analytical aptitude and desire to learn, sound judgment

- Bachelor's degree in business administration, finance, accounting or economics

- 5+ years transaction banking experience with focus on customer service, cash management, trade or securities services

6

Icg-relationship Associate Resume Examples & Samples

- Preferably with 3 years of experience in relationship management, sales, customer support or similar roles

- Knowledge of corporate relationship management, account documentation and essential banking transactions/products is preferred; familiarity with Citi's banking systems would be an advantage

- Ability to work both as an individual as well as a team contributor

- Self-motivated with keen attention to detail

- Highly proficient in using Microsoft Office (Word, Excel, Outlook, Powerpoint)

7

Relationship Associate Resume Examples & Samples

- Internal work experience within Citibank essential

- Experience in working with teams to deliver agreed service standards

- High level MS skills, especially Excel & Powerpoint

- Strong numeracy skills

- Foundation understanding of CTS and standard Treasury products

8

Relationship Associate Resume Examples & Samples

- Interpersonal skills / Networking - able to create and sustain good personal contacts within the team and amongst Citi’s product partners

- Strong MS Office, Excel Skills

- Strong Presentations Skills

- Bachelor's degree in Business related fields

9

GSG Relationship Associate Resume Examples & Samples

- Co-ordination of credit requests and approvals as appropriate (Product, PAM teams, CB, CRMS, GIRM, FIRM)

- Build a trusted relationship with clients, acting as contact for routine credit requests, navigation of the Citi product and coverage network, problem escalation and resolution, driving customer satisfaction

- Leverage the network and product partners to pursue identified opportunities e.g. CTS, FX

- Sound knowledge of ICG credit policy

- Analytical - Assimilating new information quickly and relating it to the needs of the client base

10

Relationship Associate Resume Examples & Samples

- Daily interaction with Pershing, Sales Staff, External Clients, Controllers, Compliance, CSAM, Traders, Credit Officers, IT

- Excellent teamwork, interpersonal and conflict resolution skills

- LI-CSJOB* *LI-CSJOB* *LI-CSJOB* *LI-CSJOB* *LI-CSJOB* *LI-CSJOB*

- LI-AP1* *LI-AP1**LI-AP1**LI-AP1**LI-AP1**LI-AP1*

11

Private Banking Relationship Associate San Francisco Resume Examples & Samples

- Responsible for order execution, processing and settlement of trades on client accounts

- Bachelors Degree or equivalent work experience

- Series 7 and 66 or 63 Registered

- Exceptional written, verbal communication and platform presentation skills

- LI-SL1* *LI-SL1*

12

Senior Relationship Associate Resume Examples & Samples

- Must have thorough knowledge of new account procedures and compliance requirements that must be completed in a timely manner

- Approves and authorizes ATM and debit cards, Northern Lines, cash advances, checks and certificates of deposit. Is fully capable of taking residential loan applications and can act as a knowledgeable liaison for all credit requests to the proper team or individual

- Documents and prepares reports regarding client calls. Analyzes reports and identifies potential problem situations, trends, and improvement opportunities. Initiates changes to processing as needed

- Recommends enhancements to unit management, for changes in client account set up, products, or services based on inquiries received

- Initiates client communication to add value to the relationship

- Keeps abreast of new and existing bank products and services

- Keeps abreast of laws and regulations that affect compliance issues and personal banking and services. Understands and applies laws and regulations as they relate to baking products and services

13

Relationship Associate Resume Examples & Samples

- To assist a team of RMs on ALL daily operational issues, OTs for specified portfolio of clients

- Special attention to completing KYC/AML/CADD documents for ALL accounts for the team

- Responsible for ALL matters relating to account opening

- Assist RMs in preparation and coordination of marketing activities

- Managing non-borrowing names

- Push for asset utilization of customer mainly on trade facilities

- The above is not exhaustive and the team/Head will determine the appropriate & relevant work scope from time to time

14

Relationship Associate Resume Examples & Samples

- Highly-motivated and passionate about the alternative investment business, understanding the markets and investing

- Excellent personal communication/interpersonal skills

- Must be confident, a detail oriented self-starter, extremely well-organized, and able to work on deadline and in a fast-paced team-oriented environment -- being a team player is a critical quality for this role

- Experience working with sophisticated institutional and HNW clients, prospective clients, and consultants, and a proven ability to develop new business opportunities

- Ability to develop a holistic understanding of our portfolios and investment strategy and articulate our business and convey key messages to clients about our portfolios and the markets

- Existing relationships in the Northeast and Canada important

- Minimum of 4-6 years of experience in a similar IR/Marketing role within an alternative investment firm, in particular a hedge fund

- BS/BA degree required – ideally with an emphasis in accounting, business management or finance

- Industry accreditation (CFA or CAIA) is a major plus

- Must be proficient with MS Office Suite, including Access, Excel, Word, and PowerPoint, as well as Adobe Acrobat (strong familiarity with use of the Internet and other databases a plus)

15

Service Relationship Associate Resume Examples & Samples

- Self-motivated, quick learner, well organized, patient and detail oriented; able to work under intensive and fast-paced environment

- Good knowledge about local environment, basic knowledge about banking transactions and ability to handle customers daily inquiry, transactions, maintenance, service and other logistic arrangements

- Strong communication skill and good interpersonal skill, enable to communicate articulately and persuasively with clients and internal partners

16

Private Banking Relationship Associate Miami Resume Examples & Samples

- May perform other duties and responsibilities that management may deem necessary from time to time

- Excellent Customer/Client Service skills

- LI-AP1* *LI-AP1**LI-AP1**LI-AP1**LI-AP1*

17

Relationship Associate Resume Examples & Samples

- Relationship Management: manage and plan the Bank’s relationships with a portfolio of corporate customers

- Sales: cross-sell all corporate banking products and services, including cash management, trade and treasury

- Credit Origination: overall responsibility for credit origination and the preparation of CA packages

- Credit Maintenance: prepare industry studies in line with GCIB policies, monitor on an ongoing basis customers’ businesses and existing facilities, frequently visit customers and prepare call memos thereafter, conduct Annual Reviews and Classification Memos, liaise with Credit Admin to ensure that all credit terms and conditions are respected (e.g. documentation deferrals and Annual Review dates)

- Service: Provide a portfolio of customers (GRB and TTLC names) with world-class service by understanding their businesses, financials, and needs, and how Citibank can provide solutions. People: work closely and effectively with Credit, Operations, Legal, Corporate Finance and the Product Teams in Israel and overseas

18

Relationship Associate Resume Examples & Samples

- Partner with GSG RAMs (Regional Relationship Managers) in the management of a portfolio of client relationships to generate both customer satisfaction and also achieve various business/revenue growth goals. Timely follow-up will be a critical aspect of the job

- Partner with GSG RAMs to develop a comprehensive understanding of the clients, and to execute specific account strategies. Become the client expert through developing client relationships and gaining in-depth knowledge of the customers’ business, organization and objectives in order to provide effective client service and support

- Joint responsibility, with the RAM, for the management of the regional or global network of SAMs dedicated to client relationships and daily

- Proven successful track record in working with external and internal clients

- Strong data research capability by using various tools

- Good understanding of Citi’s flow products is essential (cash management, trade, FX, loans)

- Knowledge of Citi’s credit policies and procedures

- Strong track record of working in a highly demanding environment and under pressure

- 3-5 years of banking experience, preferably in relationship management, account management or customer service areas

- Highly motivated, smart and with a can do attitude

- Success oriented

- Strong MS Office Skills

- Strong Relationship skills

- Bi-lingual preferred, (English and another European language)

- Focused and career oriented

- Strong organizational skills, ability to multitask and manage demands from several sources, working within tight deadlines

- Verbal and written communication: high degree of accuracy and attention to detail / clarity

- Educated to Bachelor or even Master Degree

19

Relationship Associate, GSG Resume Examples & Samples

- Monitor credit allocation throughout the network working with product partners, parent account manager, bankers and credit risk

- Work with client and Treasury & Trade Solutions partners in obtaining all necessary support documentation to ensure completion of KYCs as well as LCs

- For KYCs, monitor their progress and renewal through the KYC system

- Ensure timely resolution and client satisfaction on all financial and operational investigations including credit, foreign exchange, cash management, trade services, etc

- 5+ years of professional work experience in the financial service industry, specifically within Banking and/or Treasury & Trade Solutions

- Prior Treasury & Trade Solutions sales or account management preferred

- Strong credit skills/experience (e.g. financial accounting, commercial lending theories, industry awareness, loan structuring, etc.) but with good analytical aptitude and desire to learn. Knowledge of Citi’s credit policies is a requirement

- Client services experience. Front office experience preferred

- Information resourcefulness and results-oriented

- Experience with large corporate clients, capital markets products, derivatives, credit, cash management, trade, finance and securities products is highly desirable

- Bachelor’s Degree in Finance or closely related areas of Business Administration

- Fluent in Japanese

20

Service Relationship Associate Resume Examples & Samples

- Deliver a best-in-class client experience for the Citi Commercial Bank with a focus on the following core responsibilities

- Onboarding – Own the end-to-end onboarding process for new client accounts and credit facility set-up from documentation to implementation

- Maintenance - Ensure all client information is updated promptly in all systems to ensure smooth operation of client accounts and facilities

- Servicing - Make every service engagement a wow experience for clients through ensuring sincere, timely and effective completion of client’s service requests

21

Relationship Associate Resume Examples & Samples

- Co-ordination of credit requests and approvals as appropriate (Product, PAM teams, GSG, CRMS, etc.)

- Demonstrate sound knowledge of ICG credit policies and exercise prudent judgement in managing risks inherent in the business

- Global network liaison; co-ordinate routine credit requests from the network and support the network by acting as an integral interface with client head office assisting revenue generation and protection

- Leverage the network and product partners to pursue identified opportunities

- We are looking for a highly motivated person to support Bankers and thereby assist in driving revenue realisation

- Efficient knowledge of technical support systems (CRI, Citivision, CRM, Optima, eCADD etc.)

- Analytical - Assimilating new information quickly and relating it to the needs of the client base with attention to detail

- Organisational - Work independently and under pressure

- Interpersonal skills/Networking - Able to create and sustain good personal contacts within the team and amongst Citi’s product partners

- Self-starter - Prepared to take the initiative to follow issues through, whilst exercising judgment as to when to seek assistance

- Team Player - Being able to work in partnership with other individuals on day-to-day and long term projects

22

Relationship Associate Resume Examples & Samples

- Serve as primary point of contact on assigned group of custody relationships which include monitoring and reviewing account activities involving Domestic Cash transactions, foreign exchanges, overdraft and failed trade resolution

- Ability to manage multiple client accounts and projects with varying priorities and deadlines

- Process client trade instructions on various security types

- Monitor and review account activities involving global and domestic cash transactions

- Process foreign exchanges

- Process gifts and contributions

- Execute activities related to client account openings, account closings and account maintenance

- Execute daily account administration activities, process clients’ instructions and follow through with involved departments

- Responsible for completeness and integrity of client data on trust accounting system

- Assist clients with questions regarding online access

- Escalate potential service level issues to his/her Supervisor, Manager, and/or Relationship Manager

- Assist with department projects

- Ensure service level standards are met

- Bachelor’s degree in a business-related field preferred

- Exceptional customer service skills

- Experienced operating in an environment that stresses both team-based performance and individual accountability

- Ability to manage challenging external clients and special situations

- Good interpersonal skills with the ability to function effectively in a team environment

- Must be able to make decisions quickly and appropriately, sometimes in the absence of detailed instructions

- Ability to anticipate service level issues and proactively escalate as needed

23

Account Relationship Associate Resume Examples & Samples

- Initiates company stock trades, mutual fund,

- Interacts with partners on a daily basis to receive

- 1-3 years of operations or trade processing

24

Relationship Associate Resume Examples & Samples

- Responsible for ensuring assignedclient portfolio is kept current with respect to due diligence and anti-moneylaundering compliance (CADD) requirements

- Co-ordination of credit requests andapprovals as appropriate

- Demonstrate sound knowledge of creditpolicies and exercise prudent judgement in managing risks inherent in thebusiness

- Demonstrate the ability to exercise soundjudgement and use initiative, but knows when to refer, ensuring Bankers areable to focus on marketing efforts and revenue generation

- Build a trusted relationship with clients,acting as contact for routine requests, navigation of the Citi product andcoverage network, problem escalation and resolution, driving customersatisfaction

- Leverage the network and product partners topursue identified opportunities e.g. TTS, FICC

- Support Bankers on marketing efforts togrow and protect revenue on a specified portfolio of clients

- Highly motivated and experienced person tosupport Bankers and drive revenue realisation

- In-depth knowledge of/experience base inall aspects of transactional banking is helpful, with a sound knowledge ofCiti’s product range

- Sound knowledge of credit policies

- Efficient knowledge of technical supportsystems (CRI, Citivision, CRM, GRR, eCADD etc)

- Analytical - Assimilating new information quickly andrelating it to the needs of the client base

- Organisational – Work independently andunder pressure

- Verbal and Written Communication – Abilityto communicate effectively across the organization

- Interpersonal skills/Networking - able to create and sustain good personalcontacts within the team and amongst Citi’s product partners

- Self starter - prepared to take theinitiative to follow issues through, whilst exercising judgment as to when toseek assistance

- Team Player - being able to work in partnershipwith other individuals on day-to-day and long term projects

- Proactive - Identifying situations that could result innew business and developing recommendations tailored to the client

25

Private Banking Relationship Associate Resume Examples & Samples

- Active Series 7, 66 licenses are required

- Ability to work under pressure on demanding, time sensitive tasks

- Able to build trust driven relationships with relationship managers and clients

- Provide time sensitive, deadline driven, high touch support to clients

- Knowledge of financial services industry

- Knowledge of Netexchange Pro, etc

- Bachelors Degree or equivalent work experience Bachelors Degree or equivalent work experience

- Active Series 7, 66 licenses are required Active Series 7, 66 licenses are required

- Ability to work under pressure on demanding, time sensitive tasks Ability to work under pressure on demanding, time sensitive tasks

- Able to build trust driven relationships with relationship managers and clients. Able to build trust driven relationships with relationship managers and clients

- Provide time sensitive, deadline driven, high touch support to clients. Provide time sensitive, deadline driven, high touch support to clients

- Knowledge of financial services industry Knowledge of financial services industry

- Knowledge of industry rules and regulations Knowledge of industry rules and regulations

- Excellent teamwork, interpersonal and conflict resolution skills Excellent teamwork, interpersonal and conflict resolution skills

- Excellent Customer/Client Service skills Excellent Customer/Client Service skills

- Exceptional written, verbal communication and platform presentation skills Exceptional written, verbal communication and platform presentation skills

- Strong PC Skills: Microsoft Office including Microsoft Word, Microsoft Excel, PowerPoint Strong PC Skills: Microsoft Office including Microsoft Word, Microsoft Excel, PowerPoint

- Knowledge of Netexchange Pro, etc Knowledge of Netexchange Pro, etc

26

Private Banking Latam Relationship Associate Resume Examples & Samples

- Ability to speak and write in Portuguese fluently

- MUST HAVE Ability to speak and write in Portuguese fluently

- Series 7 & 63 or 7 & 66 or 65 required

- 2-3 years industry experience required

27

Private Banking Miami Latam Relationship Associate Resume Examples & Samples

- Bachelors Degree or equivalent work experience,

- Series 7 & 63&65 or 66 required

- Fluent in Spanish required

28

Relationship Associate Resume Examples & Samples

- Operate within the Companies Leadership Standards – drive client value, delivers results, works as a partner, leads changes and acts as an owner. Builds and maintains strong client relationships

- Communicate clearly and confidently to express view, ideas and opinions both verbally and in written communication/presentations. Detail oriented and good knowledge of powerpoint

- Works well independently and under pressure

- Takes initiative. Shows commitment to reaching goals. Demonstrates a profession attitude and flexible working style

- Knowledge of economics/business analysis. Facility with excel

- Demonstrate sound knowledge of derivatives products and bond offerings, M&A episodics, Forex, leverage loans, LoCs, trade products, and cash management

29

Icg Relationship Associate Resume Examples & Samples

- Excellent team skills and the ability to work effectively with a diverse group of stakeholders at all levels

- A recognized university degree with at least 2 years of banking experience

- Banking, Accounting & Finance degree will be an advantage

30

CCB Relationship Associate Resume Examples & Samples

- Manage existing base of key client relationships for transaction level support for a pool of Senior Relationship Managers

- Primary point of contact with customer for all support related escalations

- Handle documentation related to client’s on-boarding with the Commercial Bank and keep the client/RM abreast of the status

- Work on customer due diligence (eCADD)/ KYC for new to bank clients as well as annual renewals

- Regular liaison with Credit Analysis Unit, Risk and other internal units for follow-ups

- Prepare credit proposal for new to bank relationships as well as annual renewal proposals and discuss with seniors on the case

- Act as back-up for RM/SRMs as and when needed by the business

- Coordinate with Respective teams to conduct CitiDirect / FX Pulse trainings for the clients

- X-sell by partnering with product partners – Cash, Trade and Treasury products

- Manage Account opening deferral, Credit documentation deferrals, and AIR resolution

- Provide active feedback on emerging product needs of customers, competitive practices, and ideas on process/product improvement

- 2-4 years of Commercial/Corporate banking experience

- Experience in a client servicing role in UAE

- Basic knowledge of trade, lending, FX and other cash products

- Relationship skills and ability to multi-task

31

Relationship Associate Private Banking Chicago Resume Examples & Samples

- Support Private Banking Sales force and their business objectives

- Bachelors Degree or equivalent work experience, Series 7 & 63 required. 2-3 years industry experience

- LI-AP1*

32

Relationship Associate Resume Examples & Samples

- Serve as point of contact for clients (or prospects) and independently manage all follow-up and/or ongoing deliverables. Communicate and coordinate with other areas within FTCI (Legal, Marketing, Business Development, Operations, Estate Administration, Compliance, Strategic Advisory Group, etc.) in an effort to meet all client deliverables. The Relationship Associate will ensure that all areas of expertise within FTCI are leveraged as necessary to best service client

- Handle client requests and process wire transfers, discretionary principal payments, currency transactions, bill payments, deliveries/receipts, and gifts and contributions

- Partner with Relationship Managers, Portfolio Managers, and Trust Officers on large and complex family relationships and prospects through the following: administration of accounts, preparation of cash flows, fee reviews, preparation of account summaries, and preparation of customized PowerPoint presentations for use in client meetings, etc

- Partner and collaborate with the Relationship Managers, Portfolio Managers and Trust Officers to understand and identify client goals and objectives, both short-term and long-term. This may entail attending client meetings with the Relationship Manager, Portfolio Manager, or Trust Officer and participating in discussions about client needs/goals, their circumstances, and making an effort to better understand the clients’ extended family and younger generations. The Relationship Associate should be able to prioritize the client’s needs/goals within the framework of the FTCI business objectives while developing solutions to meet their needs/goals

- Review overdraft reports to determine how to rectify income overdrafts. Coordinate with PM to raise cash to rectify principal overdrafts

- Responsible for various office management tasks including: calendar management, client meeting coordination, procurement, expense report filing, etc

- Maintain marketing budget

- Plan and coordinate events

- 2-5 years of experience in the financial services industry in a client-facing role

- Detail orientation, with the ability to multi-task in a fast-paced environment

- Ability to manage projects and prioritize tasks in order to meet requested deadlines

- A self-motivated demeanor and desire to solve problems

- A strong interest in and desire to learn about trust and estates planning, wealth management and Investment Advisory laws/issues/topics

- Strong understanding and basic knowledge of industry competitors

33

Relationship Associate Resume Examples & Samples

- New Account Openings - Analyze relevant documents to begin KYC as per account opening checklist. Review and discuss account openings with Relationship Manager, Portfolio Manager or Trust Officers to determine proper administration of account, account type, requirements under state laws, dispositive provisions, beneficiaries and remaindermen, tax situs, GST status, fee analysis, etc. and in order to prepare account opening documents, and ticklers, remittance events and other account maintenance requirements. Perform legal and administrative analysis of new accounts for initial set-up of Administrative Reviews

- Coordinate with Tax Department. Identify and coordinate resolution of issues concerning tax matters arising during the course of the administration of personal, corporate or Trust accounts including situs, type of trust, fiduciary tax issues and personal tax issues, and overall tax implications of distributions

- Review overdraft report to determine how to cure income overdrafts. Coordinate with PM to raise cash to cure principal overdrafts. Perform analysis of trust income to determine whether 65 Day Rule should be elected. Coordinate same with co-trustee if necessary, and ensure proper remittances

- Manage and organize client correspondence (investment objective letters, concentration letters, mutual funds letters, investment programs, etc.)

- Prepare client books/presentations

- Take phone calls. Backup to other office assistants

- Run performance attribution

- Administrative duties including managing outlook calendars/setting up meetings, making appointments/set up conference calls, printing reports/filing/scanning/imaging client books, etc

- FedEx

- Take minutes for TOC/TIC meetings

- Assist with investment reviews

- Undergraduate degree (preferably in Finance) from a four-year college/university required or equivalent experience

- 2 years of business experience preferred

- Detail-oriented with the ability to multi-task and meet deadlines

- Proficient at Microsoft Excel, PowerPoint, and Outlook

- Well organized/high organization skills

- Tech savvy

34

Private Banking Relationship Associate Miami Resume Examples & Samples

- Bachelors Degree or equivalent work experience, Series 7 & 63 or 66 required

- . 2-3 years industry experience

- Fluent in Spanish a plus

35

FIG Relationship Associate Resume Examples & Samples

- Support the team on the compliance processes for financial institutions clients (Anti-Money Laundering, Know-Your Customer, and other correspondent banking activity related compliance checkings and approvals)

- Ensure timely and diligent completion of all compliance procedures and processes , coordinating relevant internal and external counterparties (i.e. relationship managers, Compliance Division, other relevant business partners and clients)

- Support the team in their day to day operational, administrative and organizational issues

- Proactively develop relationships with colleagues at all levels within Citi to enhance functional knowledge and resourcefulness

- It is prefarable that incumbent is familiar with economic trends and general banking functions

- Analytical, diligent and results-oriented person who can multi-task and prioritize

- Preferably minimum 1-2 years experience in a banking environment

36

Relationship Associate Resume Examples & Samples

- 5-10 years banking experience with solid knowledge of local environment, transactional banking, legal documentation and general banking

- Strong Cross Functional Management Skills (Coverage partners, Operations, Treasury etc.)

- Broad banking knowledge (Rel, Ops, Tech, Risk, XB, Treasury etc.)

- Experience in alliances and partnerships

- Existing Credit Skills would be an advantage

- Experience, knowledge and network relationships across SSA will be an advantage

- Foundation understanding of TTS and standard Treasury products

37

Relationship Associate Resume Examples & Samples

- Demonstrate the ability to exercise sound judgement and use initiative, but know when to refer, ensuring Bankers are able to focus on marketing efforts and revenue generation

- Co-ordination of credit requests and approvals as appropriate (Product, PAM team GSG, Bankers, CRMS, GIRM, FIRM)

- Develop a sound knowledge of ICG credit policies and ability to exercise prudent judgement in managing risks inherent in the business

38

Private Banking Relationship Associate Conshohocken Resume Examples & Samples

- Support Private Banking(PB) Sales force and their business objectives

- Extensive interaction and communication with traders

- Daily interaction with Pershing, Sales Staff, External Clients, Controllers, Compliance, Credit Suisse Asset Management(CSAM), Traders, Credit Officers, IT

39

Relationship Associate Resume Examples & Samples

- New Account Openings - Analyze relevant documents to begin KYC as per account opening checklist. Review and discuss account openings with Relationship Manager, Portfolio Manager or Trust Officers to determine proper administration of account, account type, requirements under state laws, dispositive provisions, beneficiaries and remaindermen, tax suits, GST status, fee analysis, etc. and in order to prepare account opening documents, and ticklers, remittance events and other account maintenance requirements. Perform legal and administrative analysis of new accounts for initial set-up of Administrative Reviews

- Assist multiple Relationship Managers with the day to day administration of accounts, including preparing presentation books, cash flows, wealth projections, Excel spreadsheets, etc

- Remain current on relevant Wealth Management and Investment Advisory laws/issues/topics (domestic and foreign). Maintain a strong knowledge in fiduciary and personal income taxation, accountings, trust and estate law, and all types of financial investments and special assets

- 1-3 years of experience in the financial services industry with client-facing experience

- Knowledge of Monte Carlo simulation model preferred

- Trust Administration background and knowledge or ability to review and interpret trust language favorable

40

Account Relationship Associate Resume Examples & Samples

- Confirms incoming/outgoing wires per administrator's request

- Open and closes accounts on the trust system; initiates request for vendor identification numbers to update client’s accounts

- Maintains cash spreadsheet for closed accounts

- Performs WEBEX or face to face Demos on the WCM/TOE systems for new clients

- Identifies recurring activity in daily processing that could lead to corporate liability; recommends changes to limit liability

- Interacts with partners on a daily basis to receive and communicate information of all aspects of a client relationship

- Assists account and relationship manager with special projects as needed

- 1-3 years of operations or trade processing experience

41

Relationship Associate, Corporate Finance Resume Examples & Samples

- Assist Corporate Finance Heads to expedite origination and execution process

- Assist Corporate Finance Heads in producing strategic content (sector and local knowledge) in order to promote strategic dialogue with clients

- Partner with Corporate Finance Heads to develop comprehensive understanding of client. Become the client expert through developing in-depth knowledge of the customer’s business, organization, and objectives in order to provide creative ideas and solutions

- With the help of the Corporate Finance Heads become knowledgeable in each of the products

- 2 years of experience in similar jobs

- Basic Financial Analysis skills

- Knowledge of credit policies and procedures and good understanding of Citi’s transactional products is desirable

- Previous internship experience in Investment Banking is a must

42

Senior Account Relationship Associate Resume Examples & Samples

- Provides maintenance and growth on assigned portfolios by cross selling and identifying credit and investment needs of clients. Cross sells bank wide products and services to clients by expanding the personal and commercial banking relationship, Treasury Management

- Demonstrates expertise in the setting up all types of client accounts and services. Is a capable of coordinating the creation loan documentation for complex loans with the Loan Documentation Team. Reviews documentation for completeness and follows through to eliminate documentation deficiencies relating to loans and deposit accounts. Opens or closes demand deposit or savings accounts, processing transactions for accounts, and resolving related operational problems

- Is called upon to share expertise in the loan and deposit area of the bank and trains others as designated by the team leader. As a member of the relationship servicing team, can act as a resource for the entire GFO group, in servicing highly complex GFO relationships

- Keeps abreast of all new products and services to respond to client and GFO custody partner’s questions and to assist in selling services

- Sets up revolving credits, term loans, and various other commitments on the loan systems using a computer terminal to extract pertinent information

- Assists in preparation and completion of reports. Reviews and corrects divisional reports such as loans outstanding, balances, fees, profit performance, expenses, and calls made. Responsible for receiving all scheduled payments of principal, interest and fees within the expectations set by credit policy. This includes ongoing direct communication with the client as well as an in-depth understanding of the loan system in order to resolve administrative errors

- 3 - 5 years of related experience in bank operations or office environment and a minimum of three years as a Banking Relationship Associate

43

Ccb-relationship Associate Resume Examples & Samples

- Client Onboarding – Own the end-to-end onboarding process for new client accounts and credit facility set-up from documentation to implementation

- Account Maintenance - Ensure all client information is updated promptly in all systems to ensure smooth operation of client accounts and facilities

- Client Servicing - Make every service engagement a wow experience for clients through ensuring sincere, timely and effective completion of client’s service requests

- 2 - 3 years of experience in banking industry of which 1 year experience in client management

- Trade Operation exposure preferred

- Ability to work and follow through on issue and track for closure independently with minimum supervision

- Be enthusiastic, self-motivated, dynamic and a good team player

- Be flexible to accept any other challenges or task within the organization

- Proficient in PC applications

44

Relationship Associate Resume Examples & Samples

- Work with client and GTS partners in obtaining all necessary support documentation to ensure completion of CADDs as well as LCs

- Provide support in reviewing revenue and tracking via Citivision, following through on any discrepancies

- Strong attention to detail and follow-up skills

- Understanding the bank's credit culture, adhering to credit policies and guidelines, and documenting and justifying exceptions, where appropriate

- Series 79 and 63 is a plus (not required)

- 7+ years transaction banking experience with focus on customer service, cash management, trade or securities services

45

China Corporate Bank Relationship Associate Resume Examples & Samples

- 3-years’ experience in banking industry

- Well-organized and quick to deliver

- Familiar with operational practice and local regulation

- Fluent oral and written English

46

Private Banking Americas Relationship Associate Dallas Resume Examples & Samples

- Support PB Sales force and their business objectives

- Resolve client inquiries regarding securities quotes, account balances, activity, and documentation, statement information, and general product and/or service information

- Resolve client complaints, inquiries, and discrepancies. Research and initiate corrections to transactions and/or account errors. Ensure timely resolution of issues

- Daily interaction with Perishing, Sales Staff, External Clients, Controllers, Compliance, CSAM, Traders, Credit Officers, IT

47

ICG SG Fi-relationship Associate Resume Examples & Samples

- Working knowledge of banking products such as cash/capital markets/custody

- Candidates with working experience of customer relationships will have an added advantage

- A recognized university degree and banking experience

48

Relationship Associate Resume Examples & Samples

- Assist multiple Trust Counsel and/or Estate Administrators with the day-to-day administration of decedents’ estates including preparing presentation books, cash flows, wealth projections, Excel spreadsheets, etc

- Interact with clients and/or outside counsel and independently manage all follow-up and/or ongoing deliverables. Communicate and coordinate with other areas within FTCI (Legal, Marketing, Business Development, Operations, Compliance, Strategic Advisory Group, etc) in an effort to meet all client deliverables

- New Account Openings - Analyze relevant documents to begin KYC as per account opening checklist. Review and discuss account openings with Trust Counsel or Estate Administrator to determine proper administration of account, account type, requirements under state laws, dispositive provisions, beneficiaries and remaindermen, tax suits, GST status, fee analysis, etc. and in order to prepare account opening documents, and ticklers, remittance events and other account maintenance requirements. Perform legal and administrative analysis of new accounts for initial set-up of Administrative Reviews

- Coordinate all aspects of estate terminations and account closing in coordination with our Trust Counsel, Investment Officer and Tax Department

- Provide support to the Estate Administrator in making distributions, wire transfers, bill paying and other actions related to the estateadministration process

- Initiate processing of wire transfers, discretionary principal payments, currency transactions, bill paying, deliveries/receives and gifts & contributions

- Ensure monthly bills are properly allocated for payment

- Assist with general office management tasks such as filing, faxing, ordering supplies, distributing mail and handling bill paying matters

- Create, maintain, and use database or other electronic or paper document management systems, legal files and other fund records

- Research as directed, provide support for any litigation or regulatory reviews

- Draft correspondence, design processes for coordinating among internal groups, create and maintain internal policies and procedures; and

- Work on special projects with team and/or attorneys

- [1 - 3 years of experience in the financial services industry or legal industry in a client-facing environment – ideally in a trust administration, corporate legal, or compliance department or law firm;]

- Proven ability to work in a fast-paced environment with multiple (and sometimes competing) deadlines

- Strong detail orientation with superior organization skills, with the ability to effectively handle various projects and deadlines and prioritize tasks

- Efficiently and effectively solve problems, demonstrating strong administrative and organizational skills, sound judgment, and personal initiative

- Strong interpersonal, collaborative, and teamwork skills

- Demonstrated ability to interact with clients and build new client relationships

- Ability to maintain confidentiality and handle sensitive client account information

- Excellent verbal and written communication skills, including writing, editing and proof-reading

- Proficiency with Microsoft Office Applications - Word, Excel, Outlook, PowerPoint, SharePoint and other database applications

49

Account Relationship Associate, GFO Banking Resume Examples & Samples

- Provides maintenance and growth on assigned portfolios by cross selling and identifying credit and investment needs of clients. Cross sells bank wide products and services to clients by expanding the personal and commercial banking relationship, Treasury Management, NTSI, etc. Interviews potential loan clients and follows through with application process. Generates new business by selectively making calls based upon special product promotions

- Sets up various types of client accounts and services. Coordinate the ordering of loan documentation with the appropriate support areas. Reviews documentation for completeness and follows through to eliminate documentation deficiencies. relating to loans and deposit accounts. Opens or closes demand deposit or savings accounts, processing transactions for accounts, and resolving related operational problems

- Interacts with partners in various areas in operating to ensure accurate set-up of new services, resolve operational problems, process various transactions, and research client inquiries. Acts as a resource for the entire Wealth Management group and a member of the relationship servicing team for highly complex Wealth Management relationships

- 2 years of related experience in bank operations or office environment

50

Citigold Relationship Associate Resume Examples & Samples

- Participate in and sometimes lead the ‘daily huddle’ before branch opening

- Support and service firm initiatives

- Perform other duties, as assigned by management

- NMLS registration; Safe Act compliant

- Positive spirited spirit, enteric energetic and enthusiastic

- Ability to establish relationships and partner effectively

- Demonstrated ability to identify client needs in order to close appropriate sales and deepen relationships in a fast-paced environment

- Ability to prioritize tasks and activities to maximize daily effectiveness; Ability to multi-task

- Ability to execute end-to-end client issue resolution and enhance the relationship through effective ownership, follow through and follow-up

- High degree of precision: Ability to efficiently and accurately process multiple and large transactions

- Ability to problem solve and analyze data with demonstration of attention to detail

- Proficiency in utilizing systems, MS Office, web based and other desktop applications

- High level of integrity and commitment to maintaining confidentiality with respect to the client and the franchise

- Minimum of 5 years financial service industry experience

- A plus

51

Account Relationship Associate Resume Examples & Samples

- If requested, performs depository duties, loan processing, and documentation and/or pays and monitors overdrafts, contacting clients as required

- Ensures that revolving credits, term loans, and various other commitments on the loan systems are set up accurately

- Supports banking relationship managers in marketing efforts and initiatives

- When applicable, arranges and attends client and prospect meetings to support banking relationship managers

- When necessary, serves as an absence replacement at the reception desk or at a banking desk

- 1 - 2 years of related experience

52

Customer Relationship Associate Resume Examples & Samples

- Review, Clean and Process customer orders in the PeopleSoft ERP system in accordance with guidelines, work instructions, contractual and audit requirements. Manage Holds, Return Material Authorisations, Credit Notes and Invoice Requests

- Provide international pre-sales and logistics support to our WW Direct Channel Partner customer base. Train Partners on how to place clean orders

- Support the team in any way necessary to service Direct Partners

- Work with Sales, Services, Logistics, Auditors, Finance, Engineering, Supply Management, and Manufacturing to resolve customer inquiries and drive process improvements

- Pay close attention to detail, well organized, good follow- through skills –aggressively brings issues and outstanding items to closure

- Maintain a high degree of customer focus, also during busy periods

- Provide order status, data analysis, and reporting as required

- Represent the team in internal and external meetings

- Maintenance and entitlement process knowledge for products

53

Private Banking Americas Relationship Associate Resume Examples & Samples

- Heavy utilization of phone to handle client needs

- Special projects as required: i.e. Tracking revenue; Client specific worksheet report preparation; Review/Research industry reports; Compare/Contrast various investment options for advisors/clients

- Bachelors Degree or equivalent work experience, Series 7 & 63 required

54

Corporate Banking Relationship Associate Resume Examples & Samples

- Support Senior Bankers in the coverage of a dynamic portfolio of corporate clients

- Conduct due diligence, credit and financial analysis applying all relevant policies as required by the Bank and Local Regulator

- Support the Team on the compliance processes (Anti-Money Laundering, Know-Your Customer, and other related compliance checkings and approvals)

- Ensure timely and diligent completion of all compliance procedures and processes, coordinating relevant internal and external counterparties (i.e. Relationship Managers, Compliance Division, other relevant business partners and clients)

- Contribute to origination and execution of financing and banking transactions from the assigned client portfolio

- Follow up local and global economy as well as the target industries and companies and be ready for the relevant analysis and actions

- Work effectively with cross-functional and cross-regional internal deal teams in delivering banking and financing solutions to the client portfolio

- Cultivate cross-selling opportunities for the various banking products and services to the assigned client portfolio

55

Senior Relationship Associate Resume Examples & Samples

- Five plus years of service support or administrative assistant experience with strong client focus

- Prior work experience in comparable functional area with support of field sales/relationship-oriented team

- Strong working knowledge of Treasury Management products and services

- High School Diploma or equivalency required. Associate Degree or higher in related field or equivalent professional work experience preferred

- Advanced PC technical competencies (Microsoft Office word processing spreadsheets graphics etc.) and Internet navigation skills

- Demonstrates excellent written verbal and interpersonal communication skills

- Strong attention to detail organizational and time management abilities

- Ability to establish and maintain effective working relationships amongst team members business/support partners and senior level management

- Ability to mentor and guide more junior Relationship Associates as needed preferred

- Self-motivated and proven ability to be proactive and anticipate needs of team

- Knowledge and understanding of more complex business principles

56

Private Banking Relationship Associate Resume Examples & Samples

- Support Private Banking (PB) Sales force and their new business objectives

- Provide any needed administrative and clerical support to PB Sales force, including documentation,mailings, creating and maintaining client and prospective client files, mass mailings, event planning etc

- Perform intensive market research in order to track new leads and follow up

- Create investment proposals and asset allocation proposals using Andromeda and other reporting tools

- Create pitch book presentations and materials for prospect meetings

- Become expert on various analytical and reporting tools, such as Andromeda, Lockwood, Bloomberg, etc

- Use discretion in managing time with prospective client meetings, analytical work, and research

- Special projects as they arise

- Undergraduate degree in business preferred

- 1-3 years Sales or Marketing experience preferred

57

Ccb-relationship Associate Resume Examples & Samples

- 2-3 years of experience in banking industry of which 1 year experience in client management

- Trade Operation exposure is preferred

- Analytical and meticulous towards work; ability to work and follow through on issue and track for closure independently with minimum supervision

58

Relationship Associate Private Banking Chicago Resume Examples & Samples

- Support Private Banking (PB) Sales force and their business objectives

- Special projects as required

- Series 7 & 63 required

- 2-3 years industry experience

59

Account Relationship Associate Resume Examples & Samples

- Performs depository duties, and documentation and/or pays and monitors overdrafts, contacting clients as required

- Perform internal audits on a monthly and quarterly basis to ensure policy and regulation compliance

- Assists in preparation and completion of reports

- 1-2 years of related experience

60

Customer Relationship Associate Resume Examples & Samples

- Review and solve issues with orders from our partners or our database of assets

- Up to 2 years’ experience

- Experience (internship) in an international environment

- Excellent oral and written English language communication skills

- Interpersonal skills in a customer-facing role

- Order management/administration

- ERP/CRM Software (e.g. Oracle, SalesForce.com, Siebel)

61

Account Relationship Associate Resume Examples & Samples

- Prepares account analysis for the banking, investment and trust relationship managers or clients. Interpret documents at the request of the relationship manager and make recommendations based off discoveries. Interacts with partners on a daily basis to receive and communicate information on all aspects of a client relationship. Keeps abreast of all new products and services to respond to client questions and to assist in selling services

- Participates in client and internal meetings as frequently as directed by the banking, investment and trust relationship managers. Responds directly to client inquiries and initiates client contact when appropriate

- Teaches and trains other divisional personnel and works to help cross train team members in the various disciplines (banking, investment and trust)

- 3-5 years of banking, investment and trust related experience

62

Relationship Associate Resume Examples & Samples

- Responsible for ensuring Almaty client portfolio is kept current with respect to due diligence and anti-money laundering compliance (CADD) requirements

- Co-ordination of credit requests and approvals as appropriate

- 7+ years` of banking experience

- Relevant experience in credit risk, relationship management, financial analysis

- Knowledge of banking regulations and products

- Fluent English (oral/ written)

- Ability to effectively problem solve

- Flexibility of approach and can do attitude

63

Ccb-relationship Associate Resume Examples & Samples

- To deliver a best-in-class client experience for the Citi Commercial Bank with a focus on ensuring timely updation and processing of all client information and making every service engagement a wow experience for clients through ensuring sincere, timely and effective completion of client’s service requests

- Proactively manage a portfolio of CCB Client relationships

- Providing clients with customized solutions/services to manage their businesses with greater efficiency

- Partnering with the operations team/clients on process re-engineering initiatives, thereby contributing to increased operational efficiencies

- Partnering with the Relationship Managers and Product Sales Managers to boost cross-sell and drive increase in share of wallet

- Take complete ownership of client servicing issues and facilitate their resolution

- Periodic client calling and face-to-face client service reviews to take customers' feedback

- Problem solutioning, understanding clients’ business and requirements and ensuring right housing in an appropriate internal client category

- Effectively handling designated credit and KYC responsibilities

- In-depth knowledge of CTS products especially Cash & Trade

- Strong client communication and relationship skills

- Excellent interpersonal skills to work effectively with clients and internal teams

- Self-starter with a passion for driving results with persistent follow-ups

64

Customer Relationship Associate FTC Resume Examples & Samples

- First point of contact for service orders placed by the partners in your assigned sales region

- Work with other Polycom departments: Sales, Logistics, Auditors, Finance and Project Managers

- Work within the context of contractual, audit and international trade requirements

- Excel working knowledge

- Pressure-resistant

- Flexible during busy periods (end of the financial quarter)

65

Icg-relationship Associate Resume Examples & Samples

- Manage CRI operations memo referrals and any approval requests raised by operations

- Liaise with the approving/control unit for credit lines allocation and preparation of letters of offer

- Coordinate account opening/maintenance (including pricing updates)

- Compliance and controls such as COB, quarterly MCA, KYC tracking and monitoring

- Participate in new initiatives/ad hoc projects to improve work efficiency and processes

- Support Relationship Managers on major deals execution and client onboarding

- At least 2-3 years of banking experience in areas such as customer service, front office or operations

- Self-starter with strong interpersonal and communication skills, diligence and has an eye for details

- A team player with positive attitude and able to work under pressure

66

Ccb-relationship Associate Resume Examples & Samples

- Client Onboarding - Own the end-to-end onboarding process for new client accounts and credit facility set up from documentation to implementation

- 2-3 years of experience in a banking industry with minimum of 1 year experience in client management

- Trade Operation exposure is essential

- Strong analytical skills and meticulous in quality of work

- Ability to work and follow through on issues and track to closure independently or with minimum supervision

- Enthusiastic, self-motivated, dynamic and a good team player

- Flexible to accept challenges or tasks within the organization

67

Relationship Associate Resume Examples & Samples

- Understand the dynamics of the local financial markets, banking industry and regulations and their impact on our clients

- Maintain wallet sizing metrics across all products for MNC client base in Australia and New Zealand

- Produce monthly portfolio reviews on client credit quality, product flows, margin analysis and revenue realisation on deal pipeline

- Respect for compliance & control

- Lateral Thinker

- Planning & organization

- Teamwork & communication

- Influence & persuasiveness

- Proactive, success & results oriented

68

Relationship Associate Resume Examples & Samples

- Works with the Trust Counsel, Estate Administrators, Relationship Managers, Portfolio Managers and Trust Officers on large and complex family relationships and prospects through the following: administration of accounts, preparing and coordinating estate plan summaries, preparation of cash flows, fee reviews, preparation of account summaries, preparation of customized PowerPoint presentations for use in client meetings, etc

- Provide support to the Estate Administrator in making distributions, wire transfers, bill paying and other actions related to the estate administration process

- Draft correspondence, design processes for coordinating among internal groups, create and maintain internal policies and procedures

- 1 - 3 years of experience in the financial services industry or legal industry in a client-facing environment – ideally in a trust administration, corporate legal, or compliance department or law firm

69

Relationship Associate Position Resume Examples & Samples

- A minimum 1 year of related experience

- General financial service industry experience

- Series 6 or 7 Registration

- MS Office (Word, Excel, PowerPoint)

- Series 63 or 66 license

70

Account Relationship Associate / Receptionist Resume Examples & Samples

- Greets visitors and performs reception “triage” as to the best way in which to handle / interact with guests, vendors, etc

- Utilizes various types of software and shipping applications in order to support all office staff with bill payments, mailing and shipping support, calendaring, research, etc

- 1-2 years of Teller experience is needed as well as excellent client servicing skills

71

Senior Relationship Associate Resume Examples & Samples

- Adheres to and supports Key’s compliance culture. Acts as resource to the Team for all DDA-related compliance matters. Promptly provides requested information for C-CAP and other internal/external audits

- Works in tandem with Relationship Managers and Credit partners to ensure daily resolution to client’s overdrafts and insufficient funds. Understands the intricate details associated with various GTM products and ability to discover root cause of issues and ensure resolution

- Coordinates set-up of new and conducts maintenance or closing of existing DDAs. Performs maintenance to RPM Analysis. Partners with Treasury Management and Retail partners as needed

- Responds to routine and complex client inquiries and resolves/refers to appropriate support partners. Submits SRTS or TGS2 requests for DDA or general service needs. Coordinates follow-up with Internal Support and clients, as appropriate, to ensure prompt and accurate completion/resolution of service requests

- Facilitates system maintenance to ensure proper portfolio assignments (i.e., CE Desktop, CRISP, CAT, CuCu, etc.). Supports Team’s Desktop and other client-relationship reporting (CE Desktop activities, pipeline, referrals). Acts as “CE Desktop Champion” and helps RMs navigate successfully through the system

- Works with Team and product partners to proactively identify and capitalize on additional cross-sell opportunities with new and existing clients. Regularly shares best practices and success stories to assist peers and other Team members with cross-sell opportunities

- Helps to lead and assist in data integrity clean-up efforts as requested

- Completes wire requests according to established LOB procedures

- Assist Team in preparation of Relationship Reviews, Pitch Books, Proposals, Term Sheets, etc., as needed

- Assist Team in call preparation, preparing agendas and sales proposals, and initiating follow-up correspondence as requested

- Supports sales management activity and reporting, including preparing materials for staff/sales meetings, report error research, etc. Coordinates meetings and scheduling, delivers on equipment requirements and organizes proper room setup, as needed

- Handles all telephone and written communications in a professional manner