Investment Banking Associate Resume Samples

4.7

(123 votes) for

Investment Banking Associate Resume Samples

The Guide To Resume Tailoring

Guide the recruiter to the conclusion that you are the best candidate for the investment banking associate job. It’s actually very simple. Tailor your resume by picking relevant responsibilities from the examples below and then add your accomplishments. This way, you can position yourself in the best way to get hired.

Craft your perfect resume by picking job responsibilities written by professional recruiters

Pick from the thousands of curated job responsibilities used by the leading companies

Tailor your resume & cover letter with wording that best fits for each job you apply

Resume Builder

Create a Resume in Minutes with Professional Resume Templates

CHOOSE THE BEST TEMPLATE

- Choose from 15 Leading Templates. No need to think about design details.

USE PRE-WRITTEN BULLET POINTS

- Select from thousands of pre-written bullet points.

SAVE YOUR DOCUMENTS IN PDF FILES

- Instantly download in PDF format or share a custom link.

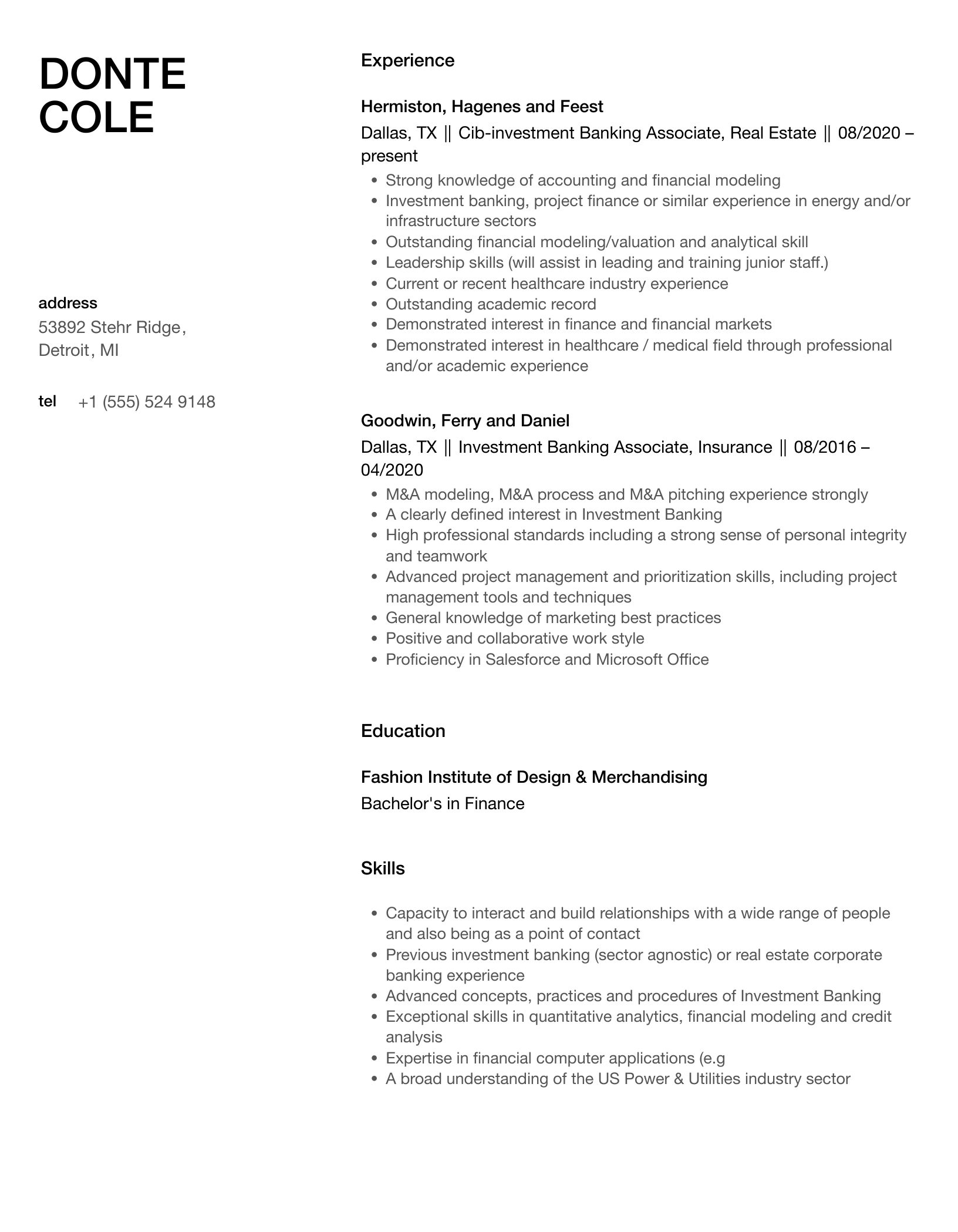

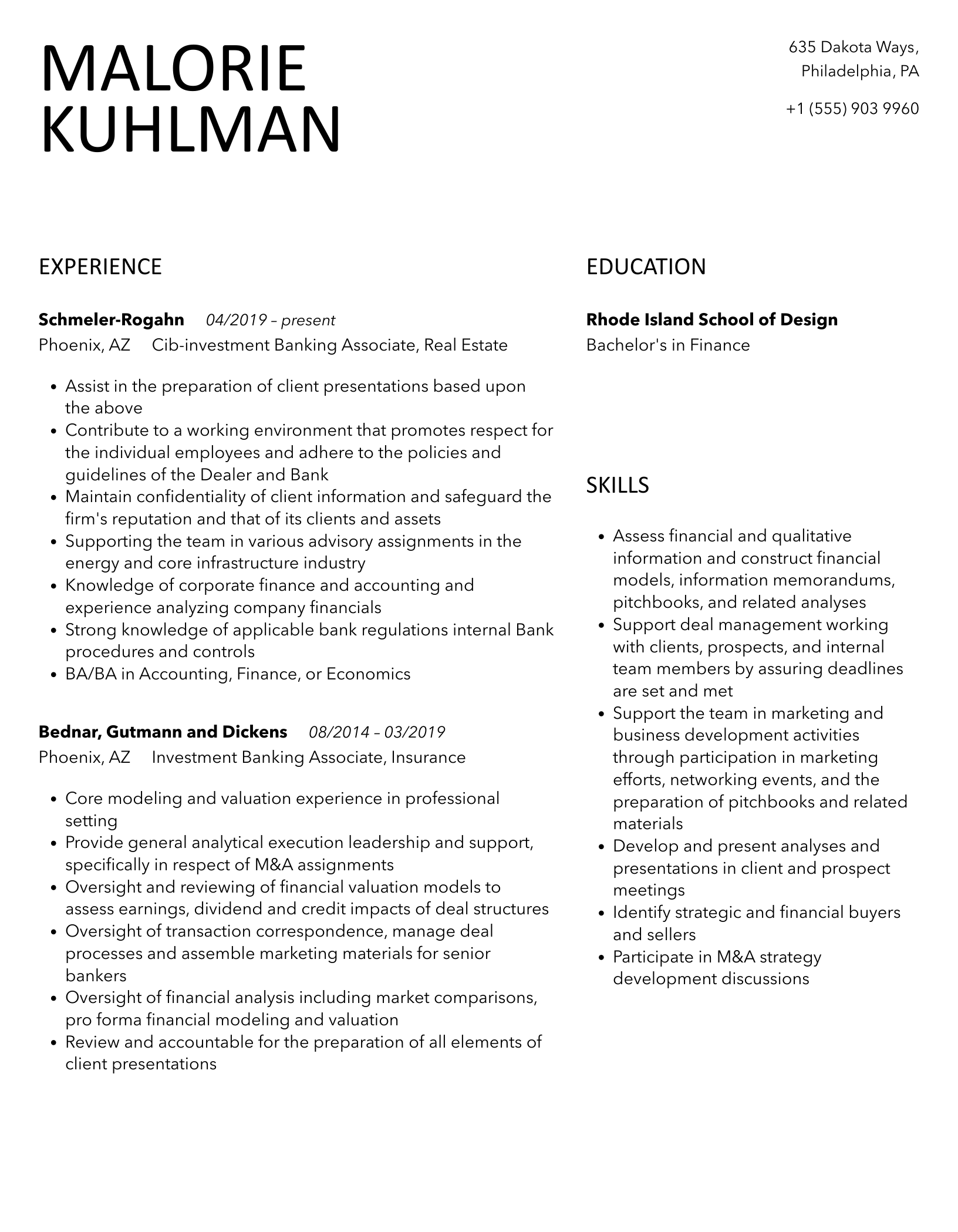

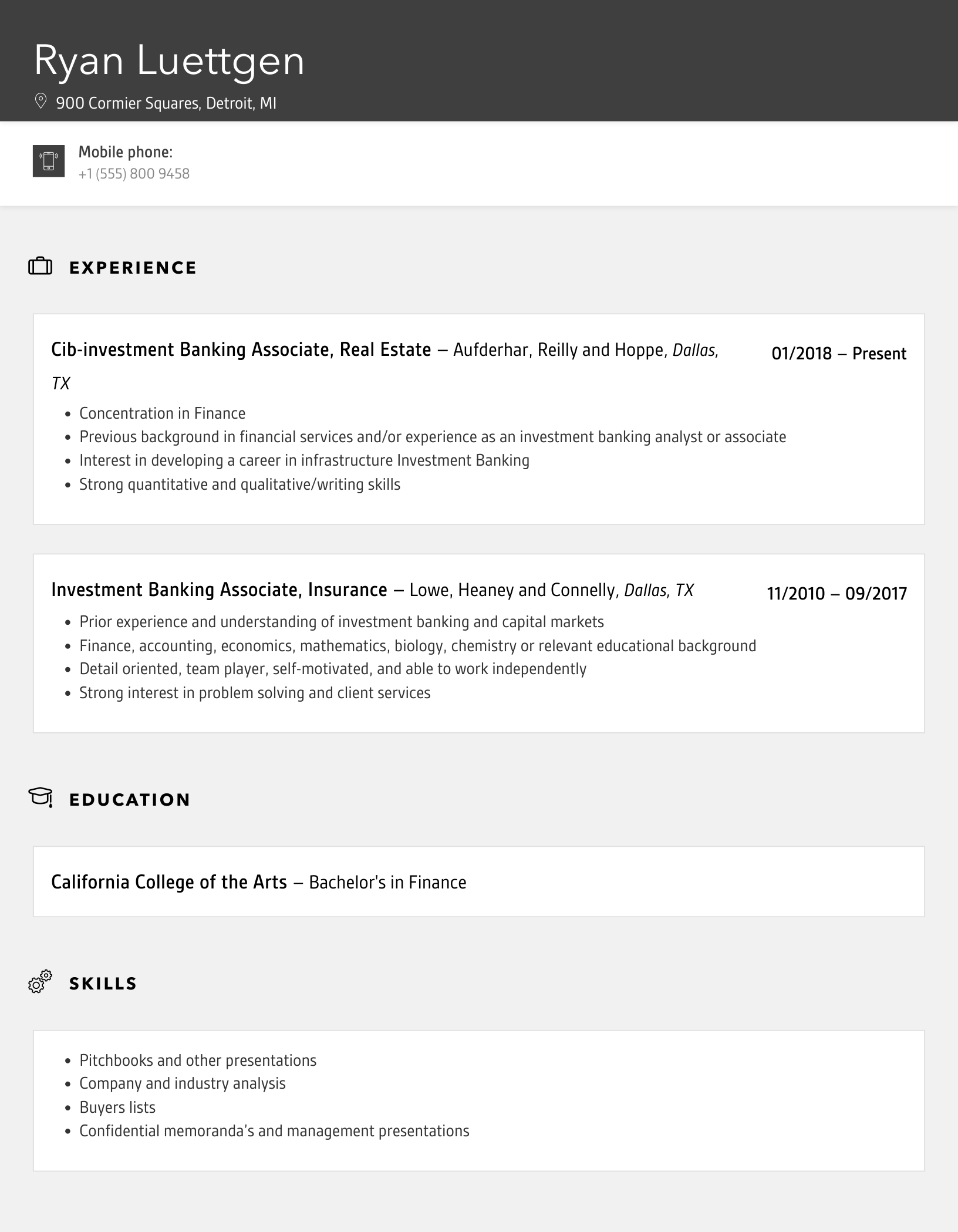

KG

K Gislason

Kelvin

Gislason

5655 Kilback Cliffs

New York

NY

+1 (555) 813 4963

5655 Kilback Cliffs

New York

NY

Phone

p

+1 (555) 813 4963

Experience

Experience

Detroit, MI

Investment Banking Associate

Detroit, MI

Gusikowski-Hamill

Detroit, MI

Investment Banking Associate

- Preparing credit papers, assisting with the credit approval process and liaising with internal stakeholders with respect to new and existing transactions

- Assisting in managing the Investment Banking relationship infrastructure, including approvals and documentation

- Execution and origination of Strategic Capital advisory work, including but not limited to: o Capital structure analysis; o Recommendation of different financing alternatives in the context of a corporate event or as a result of shift in market conditions; o Idea generation for corporate clients to solve their corporate finance issues related to capital raising, management, and deployment

- Performs other duties and responsibilities as assigned

- Working on the development of client related materials, including pitch books and new business presentations to deliver ideas on optimal financing solutions

- Preparing and supervising the preparation of sales memoranda, management presentations, marketing pitches and other presentations

- Manage the overall process regarding financial statement modeling, extensive valuation and pricing analyses

Houston, TX

Investment Banking Associate, Insurance

Houston, TX

Hudson and Sons

Houston, TX

Investment Banking Associate, Insurance

- Develop and maintain knowledge of the developments in the core product set to explore and refer opportunities

- Collaborate with Global Portfolio Management to manage the portfolio and individual client risk

- Monitor calling plans to ensure business development is pursued across the client base and that deals are replicated

- Source and create marketing material, liaising with product partners and the Senior Bankers

- Working with group MDs and Directors on managing relationships with clients and client liaison

- Exposure to an open and multicultural working environment

- Assist in managing the Corporate Banking relationship infrastructure, including approvals and documentation

present

Detroit, MI

Cib-investment Banking Associate, Real Estate

Detroit, MI

O'Reilly LLC

present

Detroit, MI

Cib-investment Banking Associate, Real Estate

present

- Performing financial valuations, utilising discounted cash flow and multiple based analyses

- Designing and implementing comprehensive M&A strategies for potential clients

- Building and using financial models

- Supporting due diligence & negotiations during transactions

- Preparing presentation materials and participating in deal pitches

- Liaising with other internal and external parties on transactions

- Marketing the full range of services to prospective and established clients

Education

Education

Bachelor’s Degree in Progress

Bachelor’s Degree in Progress

Pepperdine University

Bachelor’s Degree in Progress

Skills

Skills

- Knowledge of basic accounting and financial concepts; ability to analyze and value businesses

- Strong attention to detail

- Strong communication skills (both written & verbal) at all organisational levels - Ability to present information in a clear, creative and persuasive manner

- Extraordinarily high level of focus on work quality and attention to detail

- Solid understanding of financial modeling and the valuation process with the ability to review and edit models created by other staff

- Excellent working knowledge of Excel, Word, and PowerPoint

- Strong communication skills (both written and verbal) at all organisational levels - Attention to detail and clarity

- Highly organized, with the initiative and ability to work with limited supervision

- Strong organizational and time management skills; attention to detail

- Attracts and retains quality professionals that will have a positive impact on the SBU and Raymond James (RJ)

15 Investment Banking Associate resume templates

Read our complete resume writing guides

1

Investment Banking Associate Resume Examples & Samples

- Produces factual and accurate information presented to the client

- Trains, mentors, and evaluates interns and analysts performance potential

- Supervises the analyst's performance expectations and evaluation criteria

- Documents and supports the execution of new financing issues for corporate clients

- Identifies new entrants into the space and targets these companies for attention

- Advanced investment concepts, practices and procedures used in the securities industry

- Financial markets and products

- Analytical skills sufficient to assess and explain events in the market

- Operating standard office equipments and using required software applications, including Microsoft Office and established databases

- Bachelor's Degree in related field and a minimum of two (2) years of experience in the financial services industry

2

Investment Banking Associate Consumer & Retail Resume Examples & Samples

- Play a critical role as the project manager on teams; help manage the deal process from origination to close

- Participate in both corporate finance (debt, public and private equity) and M&A assignments

- Prepare valuations, write memorandums for M&A and private placement assignments, conduct M&A analyses, and participate in due diligence and drafting sessions for public offerings

- Manage the full analytical product created for clients

- Supervise junior staff and target areas for their development

- Foster sense of teamwork and community (recruiting, reviews, mentoring, firm committees)

- Minimum of 3-5 years post-undergraduate work experience in investment banking or a related field, preferably with a focus on the consumer and/or retail sector

- Excellent analytical, modeling and client management skills

- Significant exposure to public financing and M&A transaction analytics and processes

- Strong ability to work in an entrepreneurial culture

- FINRA licenses

3

Investment Banking Associate, Healthcare Resume Examples & Samples

- Transaction execution, new business presentations and meetings, and other such duties

- Work with Analysts in development of pitch books and related client materials

- Proactively identify operational risks/ control deficiencies in the business

- Escalate operational risk loss events, control deficiencies and risks that you identify to your line manager and the relevant risk and control functionspromptly

4

CIB Investment Banking Mid Cap Investment Banking Associate Resume Examples & Samples

- Assist regional leadership with day-to-day management of client coverage

- Manage day-to-day project deliverables to ensure the objectives of the client and deal team are achieved

- Attend various client sessions/events as well as relevant industry conferences

- Minimum of 2 years of banking or capital markets transaction experience in project/structured finance

- Education required: Bachelor's Degree or the equivalent in Business Administration, Finance, Economics, Engineering or related; Master's Degree in Business Administration strongly preferred

5

Investment Banking Associate Resume Examples & Samples

- Identify, research, and analyze M&A and financing opportunities

- Perform client due diligence

- Prepare information memoranda and other transaction-related documentation

- Prepare and contribute to delivery of client presentations and interact with senior bankers, clients, lawyers, and accountants

- Manage and develop junior staff

- MBA in finance, economics, or a related field from a top university

- 2-5 years experience in investment banking (preferably in a M&A or corporate finance setting) or related corporate industry experience

- Highly organized, with the initiative and ability to work with limited supervision

- Analytical and attentive to detail

- Effective process management abilities

6

IBD, Hedge Fund Investment Banking, Associate Resume Examples & Samples

- Develop detailed and comprehensive understanding of the Hedge Fund and Alternative Asset Management Industry

- Access top tier established hedge funds as well as startups at the founder and business leadership level

- Master strategic trends, dialogues and transactions in the alternative asset management space

- Gain broad-based knowledge across products, hedge fund investment strategies, and investor demand

- Develop understanding of the hedge fund capital structure across debt and equity at both the GP (Management Company level) and LP (Fund Level)

- Learn and practice valuation techniques of alternative asset managers, particularly in the context of M&A activity

- Directly execute and partner with industry groups to evaluate and provide financing and strategic solutions to private equity portfolio companies of target clients

- Develop understanding of how hedge funds are operated and what qualities, in addition to strong performance, lead to a successful enterprise

- Partner with and gain exposure to the full CS platform including FIG IBD, GMSG, Asset Management, Prime Services / Capital Services, Senior Relationship Management, and Sovereign Wealth Coverage

- Performing detailed financial analysis to evaluate strategic transactions or capital raises

- Developing marketing materials

- Preparing relative value trading summaries on public debt and equity securities

- Examining the impact of a transaction on a client’s capital structure and overall strategic objectives

- Ongoing industry tracking and creation of market update materials

- Acting as a point person and following up with clients on specific information requests

- Conducting primary research on industry best practices to help solve strategic issues for clients

- Demonstrated academic achievement

- Professional presence and ability to interact with senior professionals (internal and external)

- Self-starter and ready to take initiative

- Affinity to work on different projects combined with a problem solving mentality

- Ability to communicate to different types of personalities (investment banking, management, sales, legal)

- Demonstrated ability to work in a time sensitive environment

- Ability to multi-task with strong attention to detail

- Solid interest in the financial sector broadly with a focus on the financial markets

- Excellent PC skills; advanced knowledge of Excel, Word and PowerPoint a must

7

Investment Banking Associate, Technology Resume Examples & Samples

- Transaction execution, new business presentations and meetings, and other such duties

- Working with Analysts in development of pitch books and related client materials

- Proactively identify operational risks/ control deficiencies in the business

- Review and comply with Firm Policies applicable to your business activities

- Escalate operational risk loss events, control deficiencies and risks that you identify to your line manager and the relevant risk and control functions promptly

8

Investment Banking Associate Diversified Industrials Resume Examples & Samples

- Involved in both corporate finance (debt, public and private equity) and M&A

- Manage the analytical product created for clients

- Participate in recruiting, reviews, mentoring, and firm committees

- Must have three to five years experience in investment banking or related field

- FINRA licenses

9

Investment Banking Associate Resume Examples & Samples

- Structuring debt transactions across multiple industries to support leveraged buyouts, refinancings, corporate debt initiatives and acquisitions

- Working on the development of client related materials, including pitch books and new business presentations to deliver ideas on optimal financing solutions

- Getting deals approved internally including the development of committee materials, conducting in-depth due diligence on clients / proposed transactions and financial modeling

- Executing transactions, including development of financial models, rating agency presentations, marketing materials, legal documentation and assisting in selling transactions to institutional investors

- Working with and mentoring Analysts

10

Investment Banking Associate Resume Examples & Samples

- Financial modelling (operating / financial statements), with a particular focus on LBO /debt structure modelling

- Support senior managers in origination activities, including company and industry analysis, pitch book preparation and other marketing activities

- Assisting with advisory mandates and transaction execution

- Take a leading role in the execution and day-to-day management of transactions including the management of due diligence, legal documentation and liaison with external parties

- Preparing credit papers, assisting with the credit approval process and liaising with internal stakeholders with respect to new and existing transactions

- Developing relationships with junior client executives across a range of organisations

11

Investment Banking Associate Resume Examples & Samples

- Bachelor’s degree in Economics, Finance or related field from a leading university

- At least 2 years of professional experience in Corporate and Investment Banking or related field

- Advanced understanding of financial statement analysis, financial modeling and DCF analysis

- Fluent in English. Working Knowledge of Spanish is preferred, but not essential

- Good communication and interpersonal skills, with the ability to form effective working relationships

- Strong quantitative and technical/computer skills (e.g. Excel, Word, PowerPoint, Acrobat. Access Databases and Econometric products), with the ability to write macros and work with advance Excel spreadsheets

- Working knowledge of external database tools, including Bloomberg (including Excel download functions), LPC, CapitalIQ, IFR, LDC, S&P, and Moody’s, preferred

12

Cib-investment Banking Associate, Real Estate Resume Examples & Samples

- Strong accounting, finance, quantitative and business writing skills

- A well-rounded academic background from a top tier educational institution

- Have prior working experience in an investment banking front office

- Understands transaction cycle and the steps in the process and is execution oriented

- Impeccable communication details with the ability to effectively interact with senior professionals, clients and key stakeholders in other line of business

- Self-directed, highly motivated, and able to work independently

13

Real Estate Investment Banking Associate Resume Examples & Samples

- Creating financial analyses (build financial models, assess valuation / pro-forma analyses, explore corporate finance solutions)

- Gain an understanding the economics of complex financial products, such as listed stock and index options, exchange traded funds, and other investment products that senior bankers will recommend to investors

- Analyze current economic conditions and factors affecting various industries to assist in the appropriate pricing of investment products and predicting their future valuations

- Monitor economic data and assisting with advising investors on the implications of financial trends on the investment securities that they hold or are interested in acquiring or selling

- Assist with underwriting and distributing public and private financing in all principal capital and money markets

- Lead execution of M&A transactions

- Understand the global nature and demands of business today

14

Investment Banking Associate, Richardson Barr Resume Examples & Samples

- Heavy data manipulation, querying and data management via MS Excel, Access

- Generate accurate DCF models in ARIES/PHDWin and/or Excel

- Generate marketing materials including pitch books, executive summaries and data room presentations

- Create working reserves/economic databases from scratch by pulling production from various state websites, DrillingInfo/HPDI, IHS or Lasser

- Perform decline curve analysis

- Build type curves from investor presentations or from raw public production data

- Provide technical and analytical support to business development group; some building of pseudo-corporate reserve models (reverse-engineering) from SEC filings (10Ks, etc.) and public data for the business development group for pitch-related work

- Derive operating cash flow, rate of return, discounted cash flow and/or other related investment metrics and scenarios using Excel, ARIES or PHDWin

- Construct and derive price differentials, shrinkage, fixed/variable LOE parameters from client financial or P&L statements

- Model reversionary payouts, development drilling programs, net profits interests, joint venture partnerships, etc. and be able to generate various output reports (detail and oneline reports)

- Troubleshoot ARIES and PHDWin database issues or obstacles and seek solutions

- Work directly at times with clients and investment bankers on highly confidential evaluations

15

Investment Banking Associate Resume Examples & Samples

- Superior valuation skills

- Interest in developing a career in investment banking

- Investment Banking/Business Services experience

16

Investment Banking Associate Technology Resume Examples & Samples

- Play a critical role as the project manager on teams; help to manage the deal process from origination to execution

- Involved in both corporate finance (debt, public and private equity) and M&A

- Manage the analytical product created for clients

- Participate in recruiting, reviews, mentoring, and firm committees

- Must have three to five years experience in investment banking or related field

- Must exercise good judgment in assessing risks and rewards of new business opportunities

- Significant exposure to the public financing and M&A transaction analytics and processes

- FINRA licenses

17

Investment Banking Associate Resume Examples & Samples

- Bachelor degree in related fields such as Business, Finance, Financial Engineering, Economics or in other highly technical fields and strong finance/capital market knowledge

- MBA, Master’s Degree in Finance, or CFA is a plus

- Investment banking training program is a plus

- Experience in a corporate finance or capital market capacity is a plus

- Strong knowledge of capital market, financial statement analysis and corporate finance preferred

- Experience in building financial projection models of the three main financial statements (i.e. income statement, statement of cash flows, and balance sheet) preferred

- Demonstrable experience in constructing, utilizing and interpreting comprehensive financial, financing and merger models, and valuation analyses using Excel considered advantageous

- Strong computer skills, particularly in Excel and PowerPoint, preferably in CapitalIq and Bloomberg

- Results oriented; self starter

- Creative and quick learner

- Good analytical and communication skills

- Efficient and self demanding; focused on quality performance

- Committed and responsible

18

Cib Investment Banking Associate Resume Examples & Samples

- Designing and implementing comprehensive M&A, debt and equity financing strategies for potential clients

- Supporting a deal or project team with analysis and research

- Building and using financial models

- Performing financial valuations utilising discounted cash flow, and multiple based analyses

- Preparing presentation materials and participating in deal pitches

- Liaising with other internal and external parties on transactions

- Supporting due diligence & negotiations during transactions

- Marketing the full range of services to prospective and established clients

- Coordinating with product and industry groups to identify and exploit business opportunities

19

Investment Banking Associate Healthcare Resume Examples & Samples

- Superior valuation skills

- Comfortable reading and interpreting financial statements

- Extraordinarily high level of motivation and commitment to working hard

- Extraordinarily high level of focus on work quality and attention to detail

- Commercial instinct and ability to perform under pressure and tight deadlines

- Interest in developing a career in investment banking

- An MBA, CA and/or CFA designation would be an asset

- Series licensing or must obtain

20

Investment Banking Associate Resume Examples & Samples

- Identifies emerging market trends and regulatory changes within the investment and advisory domains and develops strategies to secure investment opportunities and expand the firm’s presence within the market

- Assists in the preparation of offering memoranda, transaction-related documentation and client presentations

- Excellent analytical and presentation skills

- Knowledge of basic accounting and financial concepts; ability to analyze and value businesses

- Strong Microsoft Office suite (Excel a must) and financial reporting skills

21

Investment Banking Associate, Consumer Resume Examples & Samples

- Work with Corporate & Investment bankers on M&A, strategic corporate finance, and capital raising transactions

- Associates with KeyBanc Capital Markets enjoy a unique developmental opportunity, as junior bankers have the opportunity for far greater responsibility and recognition than at other investment banks

- 3+ years direct industry segment experience

- Undergraduate Degree in Business (Accounting, Finance, Econ)

- Series 7/79 & 63 (within six months of employment)

22

Investment Banking Associate Director Resume Examples & Samples

- Structuring and execution of debt and equity financing transactions for industry companies

- Conducting valuation analyses and modelling related to financial transactions such as mergers, initial public offerings and leveraged buyouts utilizing merger consequences, public comparable, precedent transaction and discounted cash flow valuation methods

- Training and development of junior talent

23

Investment Banking Associate Resume Examples & Samples

- Performs financial modeling using excel-based workbooks

- Researches business, industry and capital markets using on-line and off-line resources

- Develops business intelligence and researches relevant to specific companies

- Prepares pitch books to support business development initiatives

- Designs, creates and builds financial models, valuation analyses, and capital adequacy analyses

- Designs and builds supporting documents and presentations for proposals and transactions

- Ensures materials are accurate, complete and client-ready

- Communicates information and analyses in both written and spoken form

- Participates in client meetings

- 3 years of experience with an investment bank or private equity company required

- Completion of a formal 2 year analyst training program preferred

- Self-starter: Ability to assess a situation and know how to break it down into tasks such as research, analysis, and valuation implications

- Advanced financial modeling skills including ability to build new models

- Thorough understanding of financial statement analysis and accounting principles

- Excellent working knowledge of Excel, Word, and PowerPoint

- Excellent writing skills, including business writing acumen

- High initiative, team oriented personality

- If not already licensed, required to become licensed securities professional by taking the Series 79 & 63 exams

24

Investment Banking Associate Resume Examples & Samples

- Preparing and supervising the preparation of sales memoranda, management presentations, marketing pitches and other presentations

- Analyzing historical and projected financial information for purposes of valuing companies and businesses

- Coordinating and performing business due diligence

- Assisting market and plan engagements

- Building relationships and maintaining direct contact with current and prospective clients

- 1-2 years of Investment Banking Associate experience

- Healthcare Industry required

- The position is in New York

25

Tech Investment Banking Associate, Boston Resume Examples & Samples

- Perform financial modeling and valuation analyses on public and private companies: comparable company analysis, precedent transaction analysis, leveraged buy-out analysis and discounted cash flow analysis

- Develop marketing materials for topics such as company positioning, financing alternatives, and M&A strategic alternatives

- MBA + >one year of experience or Undergraduate Degree in Business (Accounting, Finance, Econ) or Technical Sciences (Engineering, Physics) + three of Investment Banking experience

- Experience or demonstrated understanding of dynamics in the technology industry, especially software

- Quantitative/financial orientation, possessing the ability to succinctly express ideas

- Strong team player; motivated self-starter

- Strong Knowledge of Microsoft Office Suite (Excel, PowerPoint and Word)

- Previous investment banking, investing or other relevant client service experience. Series 79 & 63 (within six months of employment)

- Financial modeling

- Analyzing and synthesizing data

- Team player with competitive drive to win

26

Investment Banking Associate Resume Examples & Samples

- Identify and meet clients' needs in the most effective way

- Build and sustain strong relationships with both internal and external clients as well as focusing on identifying and tailoring solutions for clients' needs through in-depth analysis

- Manage transaction execution activities for clients

- Manage and support the development of junior investment bankers

- Identify and examine problems in order to understand and generate options; recommend solutions which are logical, reasonable and realistic

- Demonstrate flexibility and tolerate changes in methods and approaches

- Maintain performance and confidence in difficult, stressful, ambiguous and challenging circumstances

27

Investment Banking Associate Resume Examples & Samples

- Assistance in development of potential buyer lists

- Preparation of confidential offering memorandum

- Interaction with potential acquirers

- Development, training and mentoring of analysts

- Background in investment banking, public accounting, law, or finance

- Highly motivated, with a strong desire to be the “best of the best”

- Strong undergraduate and graduate academic performance (3.5 GPA / 700 GMAT or better)

- MBA or equivalent graduate school degree preferred

28

Investment Banking Associate Director Resume Examples & Samples

- Seek to understand client's needs, provide solutions and maintain relationships

- Consider market drivers; work to increase the returns of current and future products and services

- Generate new ideas and creative approaches which move the business forward

- 4 year Bachelor's degree or international equivalent

29

Investment Banking Associate, CME Resume Examples & Samples

- New business development including presentations and other marketing materials

- Transaction execution and due diligence for advisory and capital markets financial products

- Working with teams for the development of analyses and presentation materials used for internal and external purposes

- Develop expertise around trends and clients in the Media and Entertainment industry

- Other such duties, responsibilities and authority as may be reasonably required

30

Investment Banking Associate Director Resume Examples & Samples

- Understand client's needs, provide solutions and maintain relationships

- Quality control for work product and manage deliverable timelines

- Complete and review valuation analysis

- Research company information and industry trends

- Help develop and manage the junior team

- Create partnerships by increasing depth and breadth of existing client relationships

- Evaluate risk - use relevant information to make sound and balanced judgments

- Motivate and inspire others by providing vision of shared goals - remain committed to global strategy

- Deliver high level messages effectively and convincingly

- 4 year Bachelor's degree or international equivalent and 3+ years of investment banking experience or an MBA from a top university

- Technology, Media or Telecommunications experience preferred

- Strong modeling and valuation exposure

31

Cib-investment Banking Associate, Real Estate Resume Examples & Samples

- Designing and implementing comprehensive M&A strategies for potential clients

- Supporting a deal or project team with analysis and research

- Performing financial valuations, utilising discounted cash flow and multiple based analyses

- Building and using financial models

- Preparing presentation materials and participating in deal pitches

- Liaising with other internal and external parties on transactions

- Supporting due diligence & negotiations during transactions

- Marketing the full range of services to prospective and established clients

- Coordinating with product and industry groups to identify and exploit business opportunities

32

Investment Banking, Associate Resume Examples & Samples

- Monitors fundamental economic, industrial and corporate developments by analyzing information from financial publications and services, investment banking firms, government agencies, trade publications company sources and personal interviews

- Interprets data on price, yield, stability, future investment-risk trends, economic influences and other factors affecting investment programs

- Informs investment decisions by analyzing financial information to forecast business, industry and economic conditions

- Assists with the execution of financing transactions, financial modeling, industry and comparable company analysis

- Assists in the preparation of standard and tailored presentations and pitches

33

Investment Banking, Associate, Dubai Office Resume Examples & Samples

- Current experience as an investment banking senior Analyst or Associate

- Drive, enthusiasm, creativity and excellent interpersonal skills

- An outstanding academic record

- Arabic language skills

- Experience in the Middle East and North African regions

34

Investment Banking Associate Power & Utilities Group Resume Examples & Samples

- Participate in all stages of transaction execution, from the pitch phase through to closing

- Minimum two years of work experience in investment banking or corporate finance related role with strong financial modelling skills and previous exposure to M&A transactions

- Ability to mentor and train analysts

- Considered an asset to have previous experience in the Power & Utilities industries

- A clearly defined interest in Investment Banking

- The ability to manage multiple projects simultaneously while maintaining a high standard of work

35

Investment Banking Associate Resume Examples & Samples

- Generate ideas and analytical materials in support of client meetings

- Perform financial modeling and valuation analyses on public and private companies: comparable company analysis, precedent transaction analysis, leveraged buy-out analysis and discounted cash flow analysis

- Develop marketing materials for topics such as company positioning, financing alternatives, and M&A/Strategic alternatives

- MBA, MA in Accounting, CFA, CPA, JD or equivalent

36

Investment Banking Associate Resume Examples & Samples

- Evaluating and analyzing the financial needs of corporate clients, including the development of financial models

- Analysis of financial and capital market information, valuations, financing alternatives, and capital structures

- Conducting industry research and analysis to assist in the identification and/or analysis of potential or actual business or financing opportunities

- Participate in drafting prospectuses and marketing presentations for transactions

- Minimum two years of work experience in a relevant field. Considered an asset to have previous investment banking experience or Industry related experience (including experience in Financial Services or Diversified Industries)

37

Investment Banking Associate Diversified Industries Resume Examples & Samples

- Preparing client presentations (including compiling data and assembling presentation materials)

- Minimum three years of work experience in investment banking or corporate finance related role with strong financial modelling skills and previous exposure to M&A transactions

- Considered an asset to have previous experience in Diversified Industries

- Well-developed organizational skills in order to respond to shifting priorities on multiple projects

38

Investment Banking Associate Resume Examples & Samples

- Mentor and Guide Analysts – supervise, mentor and guide an analyst team of 3 – 4 analysts

- Strategic Assessment – work with Group leaders to develop solutions to clients’ business strategy and corporate finance needs and participate in client meetings communicating our advice

- Presentation Development – assist in developing the vision and outline for client presentations and analysis and aiding in the associated execution as necessary

- Transaction Management – with guidance from Group leaders, assume a leadership role in individual transaction management, working directly with clients in executing transaction requirements

- Financial Modeling and Analysis – build and review financial projection models and M&A combination analyses

- Develop and Review Valuation Analyses – guide Analysts and review our standard valuation methodologies, including comparable company, comparable transaction, regression, discounted cash flow analyses, etc.; and

- Demonstrated history of hard work and effort

39

Investment Banking Associate, Boston Resume Examples & Samples

- Advanced concepts, practices and procedure of Tax and Accounting

- Gather information, identify linkages and trends and apply findings to reports

- Prepare clear, effective and professional presentations

- Be proactive and demonstrate readiness and ability to initiate action

40

CIB Regional Investment Banking Associate Resume Examples & Samples

- Analyze the market and financial position of client companies and competitors

- Market, structure and execute corporate finance deals, including mergers and acquisitions, divestitures, spin-offs and debt/equity financings

- Develop models, consisting of financial statements and data, as well as required key outputs, using discounted cash flow, merger, accretion/dilution, leveraged buyout, comparable company, comparable transaction and sum-of-the-parts analyses

- Conduct due diligence on companies in connection with the valuations for merger and acquisition transactions and/or securities offerings

- Develop and manage junior resources in various project environments

- Manage all stages of transaction executions, from the pitch phase to closing

- Ensure a high level of quality in all investment banking project materials

- Candidates must possess strong entrepreneurial, analytical, quantitative, communication, business writing and client-relations skills

- Candidates must be adaptable and have the ability to work well under pressure in a demanding environment

- Candidates should be able to work independently, producing accurate, detailed materials while meeting tight deadlines

- Skills required: Must have prior experience with financial modeling; in addition, must have strong proficiency in FactSet and CapIQ as well as MS Excel, PowerPoint, Word and Outlook

41

Investment Banking Associate Resume Examples & Samples

- Creating financial analysis and strategic business analysis

- Assisting with client development (coordinate data with clients and assist in presentation of new ideas to clients)

- Working on teams (coordinate with team members and deliver projects on a deadline)

- Stay abreast of industry trends and best practices of clients’ competitors

- Tracking business development (collect research and analyze industry trends)

- Ability to identify new business opportunities and suggest solutions

- Act as a mentor and role model to analysts

- 6 years’ or more of investment banking experience at a recognized investment bank although we will also consider those with industry experience in the Resources, Power and Infrastructure sector

- An excellent academic background

- Superior analytical, quantitative and financial modeling skills

- Fluent in accounting and finance with deep knowledge of Investment Banking methodologies

- Ability to think strategically and creatively identify industry trends and provide strategic insight

- Ability to exercise judgment, prioritize tasks and work on multiple engagements

- Superior client interaction skills and commitment to serving the client

- Team player with high integrity and self-motivation

- Ambition, motivation and drive to succeed in a fast-paced, global institution and leverage the franchise to deliver superior results to the firm

42

Investment Banking, Associate Resume Examples & Samples

- Trains, mentors, and evaluates interns, analysts, and associates performance potential

- Supervises the analyst’s performance expectations and evaluation criteria

- Prepares and delivers standard and tailored presentations and pitches to clients

- Exhibits regarding all major companies in the targeted sub-sectors; having expertise in at least one sub-sector

- Originates new corporate finance ideas for clients and potential clients

- Operating standard office equipment and using required software application to produce correspondence, reports, electronic communication, and spreadsheets

- Assume full responsibility and accountability for own actions

- Demonstrate uncompromising adherence to ethical principles

- Bachelor’s Degree in related field and a minimum of four (4) years of experience in Investment Banking

43

Investment Banking Associate Resume Examples & Samples

- Responsibilities will include assisting senior bankers in the business development effort, as well as leading transaction execution teams

- The candidate will work closely with senior bankers in the group and senior management of its clients

- Candidate attributes include superior intellect, demonstrated leadership ability, attention to detail, ability to work in teams and a commitment to excellence

- Specific requirements for the indicated position include significant investment banking experience and the proven ability to lead the execution effort on a variety of complex capital markets and M&A transactions

- Candidates must also display excellent client relationship skills, the ability to sell financial solutions to sophisticated corporate officers, and an ability to learn in a fast-paced, challenging environment

- Consumer Industry Group experience is not required

44

Investment Banking Associate Resume Examples & Samples

- This position will focus on working closely with senior deal team members to execute a variety of corporate finance transactions across multiple industry sectors

- Conducting research and preparing analyses of companies, industries, capital markets, historical financial statements and prospective financial information

- Creating and authoring financial models, valuation analysis, debt capacity and capital adequacy analyses, and documents and presentations for proposals and transactions

- Identifying financing alternatives, capital sources, strategic and financial buyers

- Managing due diligence and client relationships at appropriate levels

- Manage and mentor Analysts, which will include participating in the development of the Analyst program

45

Investment Banking Associate Resume Examples & Samples

- Assists in planning the approach and writing sections of the selling document, including the outline, format and presentation. May be involved in writing other areas, including investment highlights, business description, and industry and growth opportunities

- Conducts and edits buyer research information received from Analysts; ensures information is complete and organized. May be involved in completing some research independent of Analysts. Initiates some calls and correspondence to interested buyers; completes necessary follow-up

- Assists in the preparation and review of valuation analysis to ensure information is accurate (historical data, formulas) and assists in the preparation of more complicated models

- Acts as a point person for information requests from client; participates in negotiations of confidentiality agreements and other documents used in the transaction. Develops presentation content for management review and may present at meeting; fields calls from clients, attorneys and other individuals involved in transaction process. Responsible for "client ready" deliverables

- Solid understanding of financial modeling and the valuation process with the ability to review and edit models created by other staff

- Well-developed interpersonal and communications skills to deal effectively with colleagues and clients

- High level business writing skills, including grammar, style and the ability to develop effective documents

- Proven project management and leadership skills

- Strong organizational and time management skills; attention to detail

- Awareness of developments in financial and business markets

- Exceptional work ethic and desire to work in the industry

- At least 2-3 years work experience in investment banking or finance related field

46

Investment Banking Associate Resume Examples & Samples

- Minimum of 2 years of investment banking or valuation experience at a financial analyst level

- FIG experience at a boutique, mid-market or bulge bracket preferred

- Should be comfortable working across the full range of financial products including mergers, acquisitions, capital markets, takeovers and strategic issues

- Origination as well as execution experience preferred

- A keen understanding of financial statement analysis and company valuation techniques

- Excellent analytical and research skills (such as Capital IQ, Factset, SNL and/or Thomson Financial) and a particular attention to detail

- Ability to be creative, insightful and resourceful in performance of duties

- Expertise in financial computer applications and database management tools including MS Excel. Strong proficiency in other Microsoft Office products, specifically MS PowerPoint, and the Internet

- Ability to review, assesses, and provide detailed information daily

- Excellent capability to independently and proactively service multiple clients

47

Experienced Investment Banking Associate Resume Examples & Samples

- At least one year of experience as an Investment Banking Associate or three years at the Investment Banking analyst level

- Strong preference for M&A transaction experience

- An MBA from a top tier business school preferred with approximately 3 to 4 years of post-undergraduate work experience

- Excellent writing skills to convey complex business strategies thoughtfully and concisely

48

Cib-global Investment Bank Investment Banking Associate Resume Examples & Samples

- Working as a part of the deal team to support seniors in deal origination and execution

- Performing financial valuation, discounted cash flow and multiples based analyses

- Applying the firm's approach and policies for managing risks

- Prior working experience in an investment banking front office role

- Self-directed, highly motivated, and able to work independently

49

Experienced Investment Banking Associate Resume Examples & Samples

- 2 years of Investment Banking experience in the Associate position

- Prior work experience involving financial analysis or transaction execution

- Strong knowledge of accounting and financial modeling

50

Cib-investment Banking Associate Resume Examples & Samples

- Participate in the "full cycle" of transactional execution including preparing marketing pitches, reviewing and formulating financial analysis, preparing and presenting internal committee memoranda and client presentations

- Bachelors' degree from a leading university required; MBA preferred

- A minimum of 5 years of professional experience and a minimum of 2 years of Investment Banking transaction experience

- Very strong financial modeling/valuation and analytical skills

51

Investment Banking Associate Resume Examples & Samples

- Bachelor’s degree required; business or economics degree preferred

- At least one year as an investment banking associate preferred

- Internship or prior work experience in financial services industry preferred

- Proven track record in university studies required

- Series 79 and 63 licenses required within 90 days of hire

- Detail oriented with strong analytical abilities

- Excellent mathematical, writing, verbal and computer skills

- Ability to adapt to new tasks with little notice

- Ability to manage expectations of senior bankers while working on projects simultaneously

- General understanding of accounting and finance

- Committed to satisfying internal and external customers

52

Investment Banking Associate Resume Examples & Samples

- Work on multiple projects and transactions at any given time

- Play a critical role as the project manager on many teams; help to manage the deal process from origination to execution

- Participate in both corporate finance (debt, public and private equity) and M&A transactions

- Identify ways to develop and train junior banking staff

- Active participant in firm activities (recruiting, reviews, mentoring, and other firm committees)

- Must have three to five years experience in investment banking, real estate private equity/investment management or related field

- Strong ability to work in an entrepreneurial culture

- Asset-level underwriting and market analysis

- Real estate joint venture modeling and/or Argus, a plus

53

Public Finance Investment Banking Associate Resume Examples & Samples

- Developing financial models to structure and optimize transactions

- Preparing presentations for financing proposals and new business development

- 1-3 years of previous experience in working in public finance or with public agencies

- Advanced user of Excel, PowerPoint and Word

- Strong communication and professional presence with clients required

54

Investment Banking Associate Resume Examples & Samples

- Participate in corporate finance transactions (debt, public and private equity) and M&A and restructuring assignments

- Develop integrated financial models and related valuation analyses

- Supervise and serve as a role model for junior staff and target areas for their development

- Minimum of 3 years post-undergraduate work experience in investment banking or a related field

- Must exercise sound judgement in day-to-day activities and business related situations

- Strong work ethic and ability to work in an entrepreneurial culture

- Series 63 and 79

55

Investment Banking Associate Resume Examples & Samples

- Play key leadership roles in the transaction execution process, including leading day-to-day execution of internal project teams and overseeing analysts

- Manage the overall process regarding financial statement modeling, extensive valuation and pricing analyses

- Create confidential memoranda, management presentations, marketing pitches and other presentations

56

Investment Banking Associate Resume Examples & Samples

- The Associate is expected to assume an integral role in transaction execution and client interaction

- Primary responsibilities include conducting and overseeing the preparation of financial analyses, conducting due diligence, developing offering memoranda and presentation materials, and participating in the structuring and execution of a wide variety of transactions

- Candidates should have strong analytical aptitude and presentation skills, exceptional transaction execution capabilities, a high level of professional motivation, and superior academic achievements

- Ideally, candidates will have experience in the healthcare and life sciences sector, but this is not a requirement

57

Investment Banking Associate, Mining Resume Examples & Samples

- Researching and analyzing public and private company financial statements

- Performing detailed financial modeling and valuation analysis of mining companies

- Performing mining industry research and analysis

- Preparing presentations, materials and pitchbooks to clients

- Supporting transaction teams in the execution of mining financing transactions and advisory assignments

- Other ad-hoc tasks as required

- Between 3 to 5 years of work experience

- Prior investment banking and/or mining industry related experience

- A relevant business or mining related university degree(s)

- Strong knowledge of corporate finance, accounting and financial modeling

- Hardworking with strong teamwork and verbal/written communication skills

- High level of proficiency with PowerPoint and Excel skills

58

Investment Banking Associate Resume Examples & Samples

- Minimum of three years of experience as an Analyst or one year as an Associate in leveraged lending and/or high yield financing

- MBA from top-tiered business school preferred, bachelor degree required

- Strong financial modeling skills required. Build detailed, fully-integrated financial models to construct financial projections and test their feasibility, analyze the impact of proposed transactions on capital structures, cash flows, debt service requirements, compliance with and financial covenants, and differences in GAAP and tax treatments, etc

- Experience analyzing financial statements and related data to assess historical financial performance and future outlook for client companies and prospects

- Outstanding leadership skills; track record of success and high performance

- Ability to manage expectations of senior bankers, other deal team members and clients while working on multiple projects simultaneously

59

Investment Banking Associate Resume Examples & Samples

- Teamwork and active participation in firm activities

- At least 3 years of full-time work experience in investment banking, with significant exposure to the M&A deal process

- Strong skills and experience in analyzing businesses and their financials supported by deep knowledge of accounting

- Must be capable of producing high quality work products independently and as part of a collegial team

- Excellent communication skills (both in written materials and verbally)

- Comfort in working directly with senior client executives and PE/VC firms

- Ability to work in an entrepreneurial culture

- Demonstrated problem solving abilities and judgment

60

Investment Banking Associate, Real Estate Resume Examples & Samples

- Assisting with client development (coordinate data with clients, assist in presentation of new ideas to clients)

- Working on teams (coordinate with team members, deliver projects on a deadline)

- Ability to identify new business opportunities and suggest solutions

- 5 years or more of investment banking experience at a recognized investment bank although we will also consider those with industry experience in the real estate sector

- An excellent academic background

- Superior analytical, quantitative and financial modeling skills

- Fluent in accounting and finance with deep knowledge of Investment Banking methodologies

- Ability to think strategically and creatively identify industry trends and provide strategic insight

- Superior client interaction skills and commitment to serving the client

- Ambition, motivation and drive to succeed in a fast-paced, global institution and leverage the franchise to deliver superior results to the firm

61

Investment Banking Associate Director Resume Examples & Samples

- A degree from a top tier university

- Experience in building financial models and preparing presentation materials

- Strong understanding of banking products, capital structure and capital markets

62

Investment Banking Associate Resume Examples & Samples

- Support senior bankers in researching and creating marketing pitch materials, building financial models to value potential clients, and researching companies as determined by senior bankers

- Assist in active equity and merger & acquisition transaction execution including, but not limited to: financial analysis, model creation, drafting memoranda, due diligence, attending client meetings and drafting sessions, creating data rooms, and any other support services required to assist in closing an engagement

- Travel to client meetings, drafting sessions, road show stops and due diligence as necessary

- Participate in any other requests from senior bankers or clients

63

Investment Banking Associate KBW Depositories Resume Examples & Samples

- An Undergraduate degree in finance, accounting, or a field that demonstrates quantitative abilities

- MBA or a graduate degree not required, but could be a positive depending on prior work experience

- Three to five years of work experience, investment banking experience is a significant positive

- Ability to effectively manage multiple simultaneous project deadlines

64

Investment Banking Associate Consumer & Retail Resume Examples & Samples

- Demonstrated analytical rigor and attention to detail

- Outstanding mathematical and computer skills

- Superior communication skills; ability to write, speak, and listen efficiently and effectively

- Ability to switch priorities and move quickly among different tasks with little notice

- Ability to manage projects independently and manage expectations of senior bankers

- Ability to balance workload and manage multiple projects simultaneously

- Commitment to satisfying internal and external clients

- Bachelor’s degree required; business or economics degree preferred

- MBA from top-tier business school preferred

- Proven track record in university studies

- Internship or prior work experience in financial services industry desired

- Solid understanding of accounting and finance

- Series 79 and 63 licenses required within 90 days of hire

65

Investment Banking Associate Resume Examples & Samples

- Concepts, practices and procedures of Tax and Accounting

- Prepare and deliver clear, effective and professional presentations

- MBA Degree with two (2) years of Associate level experience in Investment Banking in the Financial Services/Bank/Depository space is preferred

66

Investment Banking Associate Resume Examples & Samples

- Manage valuation advisory engagements

- Review valuation advisory deliverables

- Conduct industry and company-specific due diligence related to transactions

- Manage, and directly assist in, the preparation of pitch books, confidential information memorandums, and management presentations

- Manage internal execution of transactions including sell-side M&A advisory, buy-side M&A advisory, debt and equity capital raising transactions for companies across a variety of industries

- Mentor and train Analysts

- Maintain client relations during deal execution

- Assist with ad hoc internal projects and business development initiatives

- 2+ years investment banking experience

- M&A transaction experience

- Exceptional work ethic that can accommodate a demanding profession

- Highly organized with the ability to multi-task

- Good team player with the ability to work under pressure

- 4-year degree from an accredited university

67

Investment Banking Associate, Industrials Resume Examples & Samples

- Assists with the execution of M&A and financing transactions, financial modeling, industry and comparable company analysis

- Produces factual and accurate information that’s presented to the client

- Trains, manages and mentors interns and analysts and evaluates their performance potential

- Seeks opportunities for development through the job itself, through special assignments, training, or external activities

- Concepts, practices and procedures of Investment Banking

- Positioning sell-side pitches and executing sell-side mandates

- Strong command of sell-side timelines and processes

- Defining high standards of quality and evaluate products, services, and own performance against those standards

68

Investment Banking Associate Resume Examples & Samples

- Operating standard office equipment and using required software application to produce correspondence, reports, electronic communication, and

- Bachelor’s Degree in related field and a minimum of three (3) years of experience in Investment Banking

- MBA Degree with experience in Investment Banking Preferred

69

Investment Banking Associate, Germany Resume Examples & Samples

- Conduct research on companies, industries, corporate finance topics to support the business

- Responsibility for managing development of financial analysis and presentation materials

- Build financial models for valuation and financial impact analysis

- Draft internal and external transaction documentation, incl. new business memoranda, M and A process marketing documents (e.g. information memoranda), analyst and investor presentations, etc

- Develop and cultivate client relationships on executive management and management level

- Responsibility for managing partners upwards and downwards, across teams and external parties (e.g. client, lawyers, consultants)

- Strong quantitative and analytical skills (incl. financial modelling)

- Demonstrate a working knowledge of a broad spectrum of banking products and how they meet client needs

- Experience of transactions and understanding of the M and A and financing execution processes

- Thorough understanding of key accounting, finance, economics and valuation concepts

- High level of self-motivation, commitment and dedication with ability to work under time pressure, multi-task and meet deadlines

- Excellent interpersonal skills – ability to create and sustain good personal contacts, balancing client requirements and Citi’s priorities

- Networking – maintaining close contact with product and industry partners within Citi

- Team Player – ability to work in partnership with other individuals on day-to-day and long term projects

- Committed to Citi’s work ethics and values

70

Investment Banking Associate, Tech Services Resume Examples & Samples

- Assists with the execution of M&A and financing transactions, financial modeling, industry and comparable company analysis

- Prepares and delivers standard and tailored presentations and pitches to clients

- Produces factual and accurate information that’s presented to the client

- Trains, manages and mentors interns and analysts and evaluates their performance potential

- Seeks opportunities for development through the job itself, through special assignments, training, or external activities

- Concepts, practices and procedures of Investment Banking

- Investment concepts, practices and procedures used in the securities industry

- Concepts, practices and procedures of Tax and Accounting

- Financial markets and products

- Analyzing and interpreting financial statements

- Analytical skills sufficient to assess and explain events in the market

- Problem solving skills and the ability to think independently sufficient to market ideas

- Defining high standards of quality and evaluate products, services, and own performance against those standards

- Operating standard office equipment and using required software application to produce correspondence, reports, electronic communication, and

- Gather information, identify linkages and trends and apply findings to reports

- Attend to detail while maintaining a big picture orientation

- Remain cognizant of our commitment to daily workflow and regulatory compliance during high volume activity

- Establish and maintain effective working relationships at all levels of the organization

- Work independently as well as collaboratively within a team environment

- Assume full responsibility and accountability for own actions

- Demonstrate uncompromising adherence to ethical principles

- Prepare and deliver clear, effective and professional presentations

- Be proactive and demonstrate readiness and ability to initiate action

- Lead the work of other and provide training, coaching and mentoring

- Interpret and apply policies and identify and recommend changes as appropriate

- Use appropriate interpersonal styles and communicate effectively, both orally and writing, with all organizational levels

- Bachelor’s Degree in related field and a minimum of three (3) years of experience in Investment Banking

- MBA Degree with experience in Investment Banking Preferred

71

Investment Banking Associate Resume Examples & Samples

- Two to three years of prior Investment Banking experience (experienced Investment Banking Analysts will be considered)

- Excellent written and verbal communication skills, including ability to develop rapport with existing and potential clients

- Strong knowledge of accounting, valuation techniques, and financial modeling

- Open to candidates with management consulting experience in Life Sciences

- LI-MH2

72

Investment Banking Associate Resume Examples & Samples

- MBA degree in Finance, Accounting and/or Economics or related field

- 1 year of experience as an Associate level Investment Banker required

- Experience performing financial modeling and analysis

- Strong understanding of financial statements

- Experience working both independently and collaboratively with a team on multiple tasks and assignments

- Ability to design and provide research-based financial recommendations as well as develop actionable solutions

- Travel up to 60% may be required, dependent on role and location; must live in or be willing to relocate to Charlotte, Dallas, Chicago or Los Angeles

73

Investment Banking Associate Year Resume Examples & Samples

- Currently the sector team has a sub-team of one Director, one Associate and one Analyst focusing on advisory and capital markets projects and this additional Associate will be required to support this sub-team

- Develop client pitch books, primarily using PowerPoint

- Build financial models using Excel

- Conduct valuation analysis (trading and transaction comps, discounted cash flow analysis, IRR analysis)

- Conduct market research as required for marketing and execution

- Assist to prepare other transaction regulatory and marketing materials, such as prospectus documents, teasers, information memorandums, etc

- Assist in the due diligence requirements for transactions

- Play an active role in the deal teams to support transaction execution

- Train the analyst on preparing models and pitches

- Attend client calls and meetings as and when requested (overseas travel will be required)

- Minimum Honors Bachelor's degree at a well-recognized institution

- Minimum 5 years Investment Banking M&A and Capital Markets work experience

- Preference for fluency in Mandarin

74

Investment Banking Associate Resume Examples & Samples

- Play a critical role as the project manager on teams to manage the deal process from origination to close

- Participate in corporate finance (debt, public, and private equity), and M&A assignments

- Supervise junior staff and target areas for their development

- Excellent analytical, modeling, and client management skills

- Significant exposure to capital raising and M&A transaction analytics and processes

- Experience within the insurance sector

- MBA from a top business school

75

Investment Banking Associate Resume Examples & Samples

- Investment Banking experience

- Specific experience executing Mergers and Acquisitions, Acquisition and Corporate Financing transactions including High Yield debt, Leveraged Loans, Equity, Convertible Bonds, Investment Grade Debt and Investment Grade Loans in both Public and Private markets

- Educational or work experience related to financial services organisations

- Knowledge or experience in CEEMEA coverage or region would be advantageous

- Strong communication skills (both written and verbal) at all organisational levels - Attention to detail and clarity

- Ability to efficiently plan and organise own workload within tight deadlines

- CEE language would be advantageous

76

Investment Banking Associate, Insurance Resume Examples & Samples

- Working with group MDs and Directors on managing relationships with clients and client liaison

- Working with group to execute transactions and share into responsibility to run deal timetable day-to-day

- Responsibility for managing production of analytics and presentation materials

- Responsibility for co-ordination of working parties upwards and downwards, across teams and external parties (e.g. client, lawyers, consultants)

- Provide support in origination and execution of Corporate Finance Transactions

- Develop and maintain knowledge of the developments in the core product set to explore and refer opportunities

- Source and create marketing material, liaising with product partners and the Senior Bankers

- Maintain regular and frequent dialogue with product partners to assist with relationship maintenance

- Assist in managing the Corporate Banking relationship infrastructure, including approvals and documentation

- Produce and update client plans in conjunction with product partners

- Monitor calling plans to ensure business development is pursued across the client base and that deals are replicated

- Collaborate with Global Portfolio Management to manage the portfolio and individual client risk

- Interact with Citi’s network around the globe to ensure activities are co-ordinated across the franchise

- Mentor analysts, provide detailed guidance and feedback, manage information flow to and from analyst, share credit and exposure with analyst as appropriate

- Substantial work experience within a financial services organisation

- Experience of analysing financial data and financial modelling

- Demonstrate a working knowledge of a broad spectrum of products and how they meet client needs

- Experience with various clients, capital markets products, derivatives, credit, cash management, trade, finance and securities

- Credit trained within a leading Corporate/Investment Banking organisation; used to taking a lead role in establishing the creditworthiness of counterparties

- Experienced at client planning and coordinating input from multiple product areas

- Experience of transactions and understanding of the execution process

- Knowledge of (Power Sector) would be advantageous

- Knowledge of accounting, legal and compliance principles and procedures relating to the role

- Advanced MS Excel and PowerPoint skills

- Ability to work efficiently within a team environments and as an individual contributor

- Strong communication skills (both written and verbal) at all organisational levels - Ability to present information in a clear, creative and persuasive manner

- Ability to efficiently plan and organise own workload within tight deadlines

- Second European language would be advantageous

- Fluent in English, both written and verbal

- Analytical - Assimilating new information quickly and relating it to the needs of the client base

- Organizational – Managing demands from several sources and working to deadlines

- Proactivity - Identifying situations that could result in new business and developing recommendations tailored to the client

- Attention to detail and assuming responsibility over time for client contact

- Educated to degree level with a minimum grade 2:1 (or equivalent experience)

- MBA qualification or advanced degree would be highly advantageous (or equivalent experience)

77

Investment Banking Associate Resume Examples & Samples

- Collaborate with Global Portfolio Management to manage the portfolio and individual client risk

- Experienced at client planning and coordinating input from multiple product areas

- Strong communication skills (both written & verbal) at all organisational levels - Ability to present information in a clear, creative and persuasive manner

- Fluent in English, both written & verbal

- MBA qualification or advanced degree would be highly advantageous (or equivalent experience)

78

Investment Banking Associate KBW Financial Institutions Investment Banking Resume Examples & Samples

- MBA or a graduate degree not required, but could be a positive depending on prior work experience

- Three to five years of work experience, investment banking experience is a significant positive

- Solid work ethic

79

Investment Banking Associate, Software Resume Examples & Samples

- Work with corporate finance investment bankers and product partners on M&A, strategic corporate finance, and capital raising transactions in the Technology sector

- Perform financial modeling and valuation analyses on public and private companies: comparable company analysis, precedent transaction analysis, leveraged buy-out analysis and discounted cash flow analysis

- Develop marketing materials for topics such as company positioning, financing alternatives, and M&A strategic alternatives

- Develop knowledge of relevant information resources: Bloomberg, Capital IQ, Thomson Financial, etc

- MBA + >one year of experience or Undergraduate Degree in Business (Accounting, Finance, Econ) or Technical Sciences (Engineering, Physics) + three of Ibanking experience

- Strong quantitative skills, including financial modeling and financial statement analysis

- Quantitatively and financially-oriented, possessing the ability to succinctly express ideas

- Excellent organization, communication and research skills

- Strong team player; motivated self-starter

- Desire to be part of close-knit group operating in an intensive environment

- Strong Knowledge of Microsoft Office Suite (Excel, PowerPoint and Word)

- MBA, MA in Accounting, CFA, CPA, JD or equivalent

- 3+ years investment banking experience in an industry group

- Previous investment banking experience. Series 79 & 63 (within six months of employment)

- Financial modeling

- Analytical acumen

- Analyzing and synthesizing data

- Team player with competitive drive to win