Investment Banking Analyst Resume Samples

4.5

(155 votes) for

Investment Banking Analyst Resume Samples

The Guide To Resume Tailoring

Guide the recruiter to the conclusion that you are the best candidate for the investment banking analyst job. It’s actually very simple. Tailor your resume by picking relevant responsibilities from the examples below and then add your accomplishments. This way, you can position yourself in the best way to get hired.

Craft your perfect resume by picking job responsibilities written by professional recruiters

Pick from the thousands of curated job responsibilities used by the leading companies

Tailor your resume & cover letter with wording that best fits for each job you apply

Resume Builder

Create a Resume in Minutes with Professional Resume Templates

CHOOSE THE BEST TEMPLATE

- Choose from 15 Leading Templates. No need to think about design details.

USE PRE-WRITTEN BULLET POINTS

- Select from thousands of pre-written bullet points.

SAVE YOUR DOCUMENTS IN PDF FILES

- Instantly download in PDF format or share a custom link.

ML

M Lockman

Maye

Lockman

7037 Keon Park

San Francisco

CA

+1 (555) 178 9324

7037 Keon Park

San Francisco

CA

Phone

p

+1 (555) 178 9324

Experience

Experience

Los Angeles, CA

Investment Banking Analyst

Los Angeles, CA

Barrows LLC

Los Angeles, CA

Investment Banking Analyst

- Developing relationships with peers in other organisations, including other advisors in order to develop market awareness and build a network

- Develop relationships with peers in other organisations, including other advisors in order to develop market awareness and build a network

- Assist with attracting a quality workforce, i.e. college recruiting activities

- Identification and implementation of process improvement opportunities based on feedback from team members and active monitoring of key performance indicators

- Work in a team environment and develop relationships – both internally and externally

- Create pitch books and other presentation materials, cover market research and perform due diligence

- Performing various control related functions such as SOX, self-audits, periodic reconciliations, production & reconciliation of management reporting, etc

Chicago, IL

Cib-investment Banking Analyst

Chicago, IL

Kuphal Inc

Chicago, IL

Cib-investment Banking Analyst

- Provide project management support to senior team members

- Providing project management support to senior team members

- Day to day management of transaction work streams

- Working as a part of the deal team to support seniors in deal origination and execution

- Develop and sensitise financial models

- Leads by example with attitude and work ethic

- Building a strong network both internally and externally

present

Houston, TX

Investment Banking Analyst / Associate

Houston, TX

Rath, Brekke and Ullrich

present

Houston, TX

Investment Banking Analyst / Associate

present

- Collaborating with Global Portfolio Management to manage the portfolio and individual client risk

- Working with management on transaction terms

- Develop and update analyses to support marketing activity, and coordinate with bankers on delivery of project work

- Source and create pitch and marketing material, liaising with product partners and the Bankers

- Involved in day to day project management and execution support

- Monitoring calling plans to ensure business development is pursued across the client base and that deals are replicated

- Building detailed financial models and performing financial and valuation analyses and preparing presentation materials

Education

Education

Bachelor’s Degree in Finance

Bachelor’s Degree in Finance

University of California, San Diego

Bachelor’s Degree in Finance

Skills

Skills

- Solid financial analysis skills, with the ability to produce accurate presentation material quickly (you get it, and can communicate it to others)

- Strong work ethic, exceptional attention to detail, and ability to manage multiple deadlines under pressure

- Extraordinarily high level of focus on work quality and attention to detail

- Detail-oriented, organized and able to work as part of a team

- Detail oriented and very good problem solving skills

- Ability to work on several projects concurrently and possess the desire to learn quickly in a fast-paced and dynamic environment

- Strong attention to detail

- Microsoft Excel proficient (Pivot tables, V-Look Ups, Macros, etc.)

- Strong communication skills (both written & verbal) at all organisational levels - Attention to detail and clarity

- Strong interpersonal skills, flexibility and ability to work well in teams

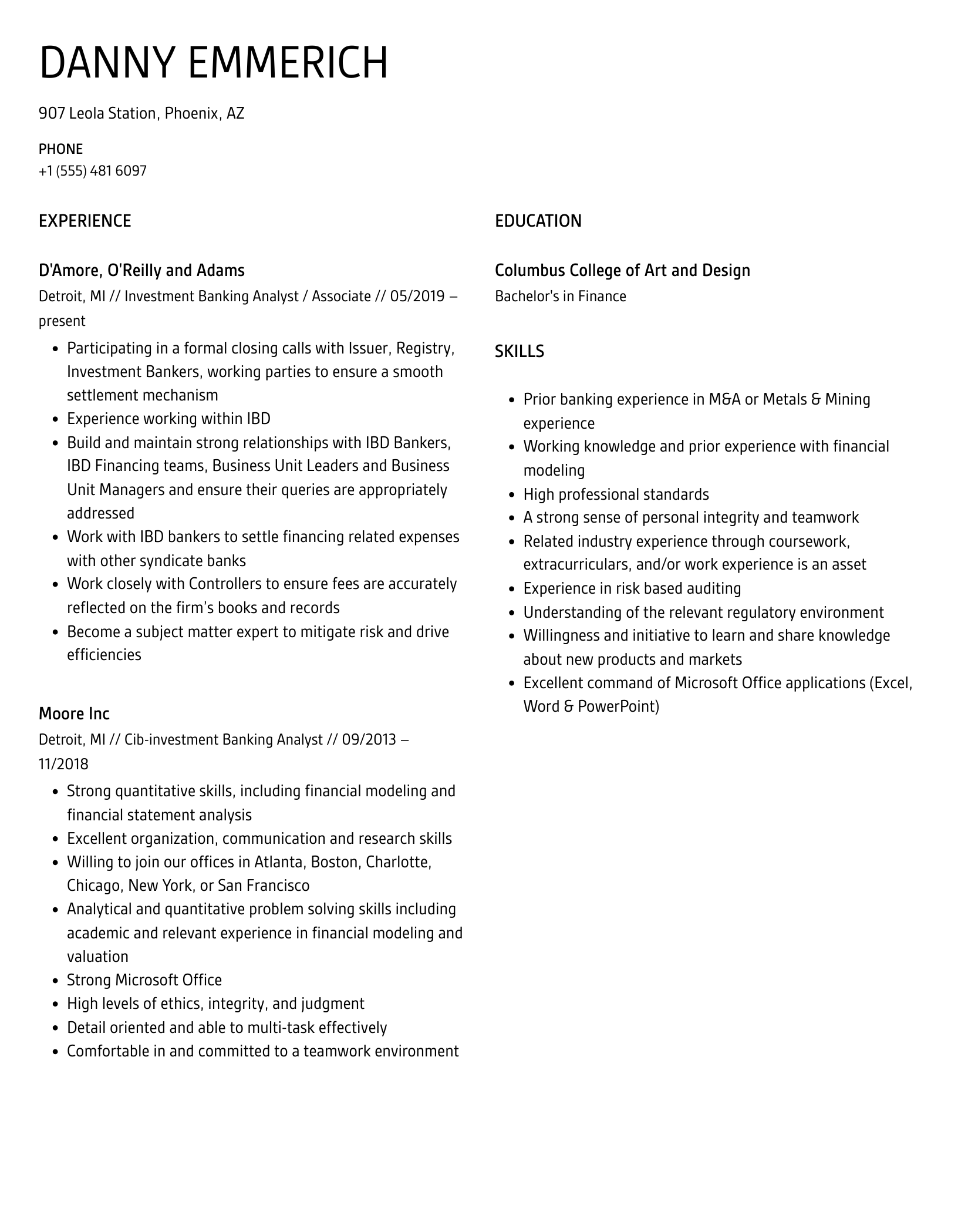

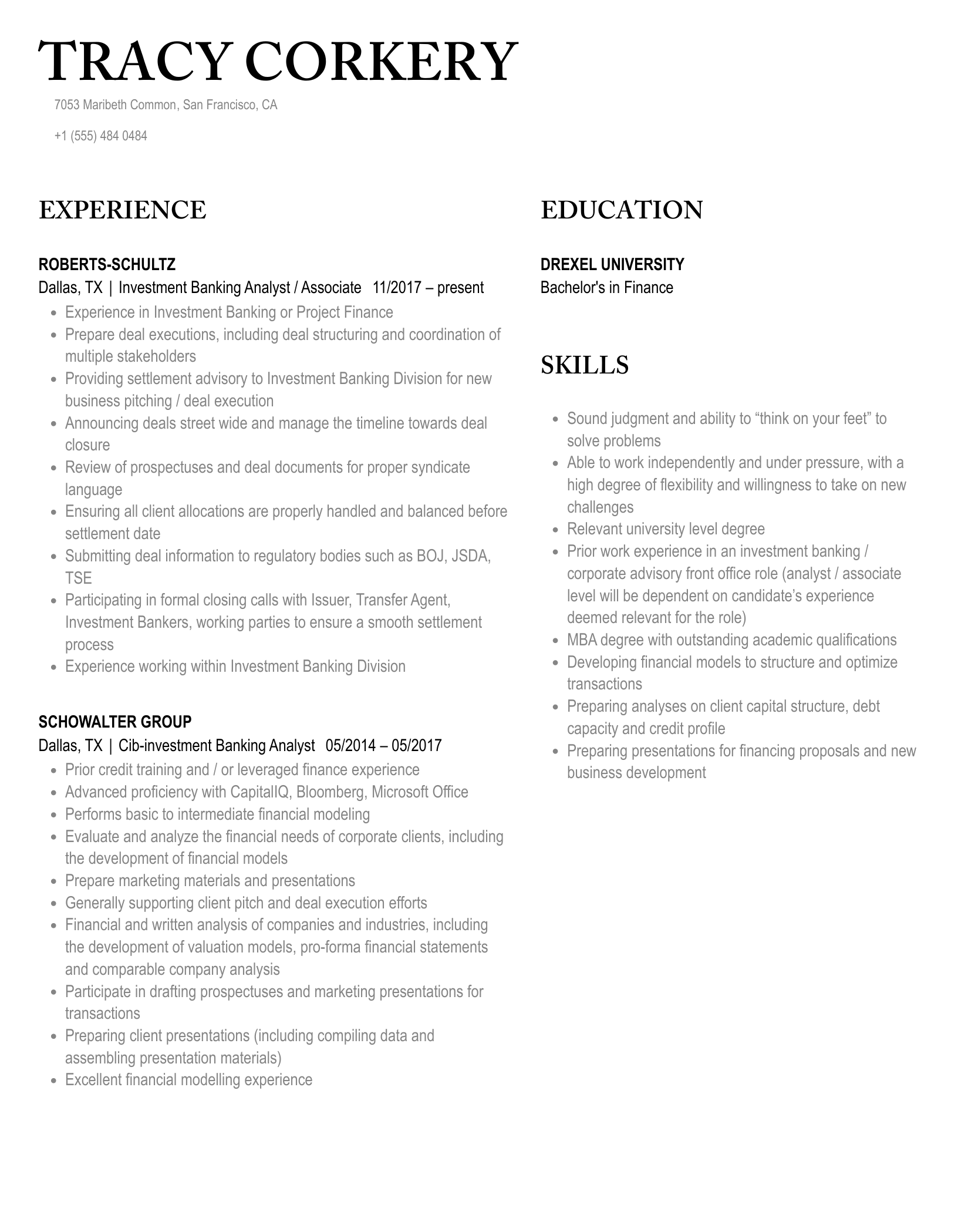

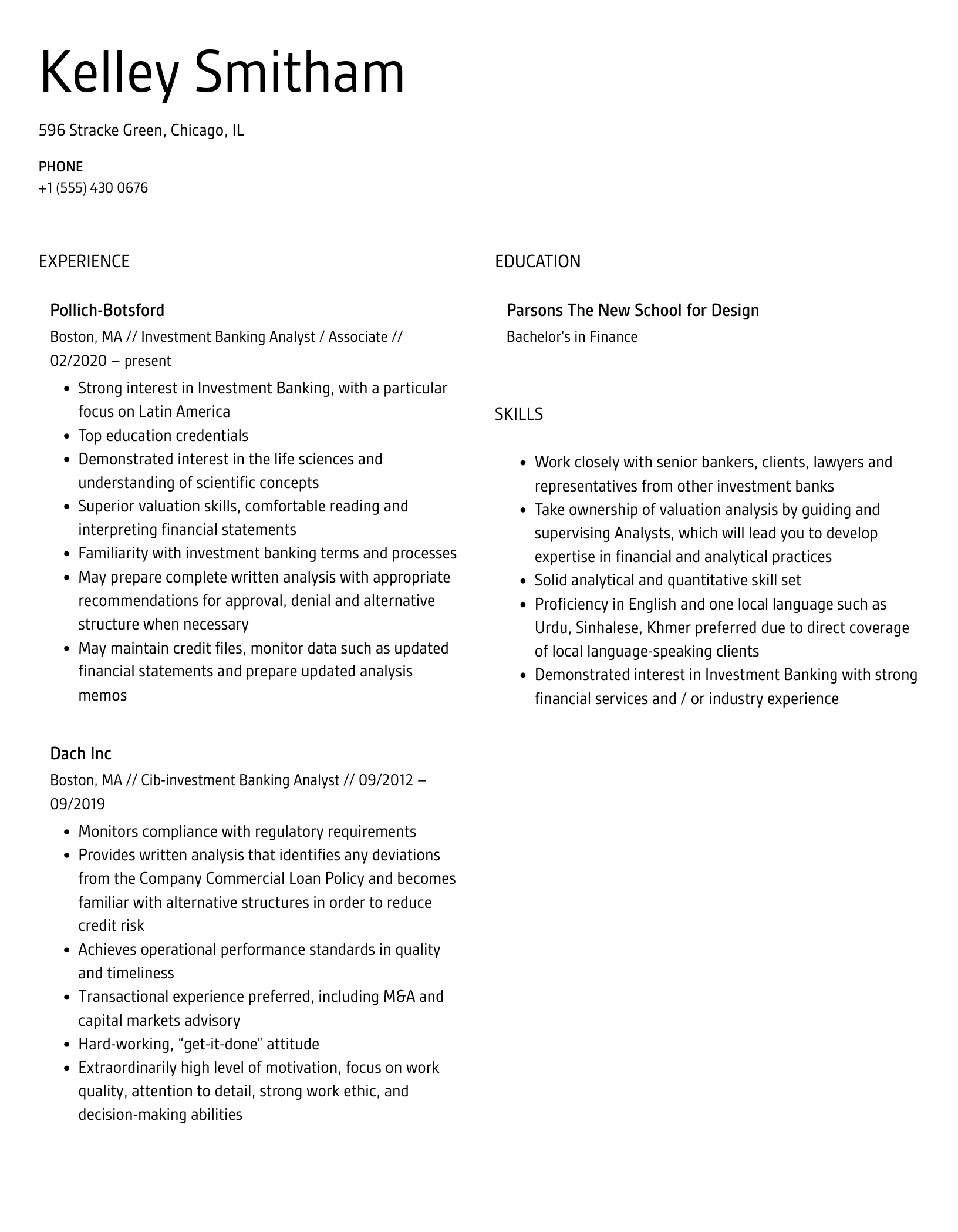

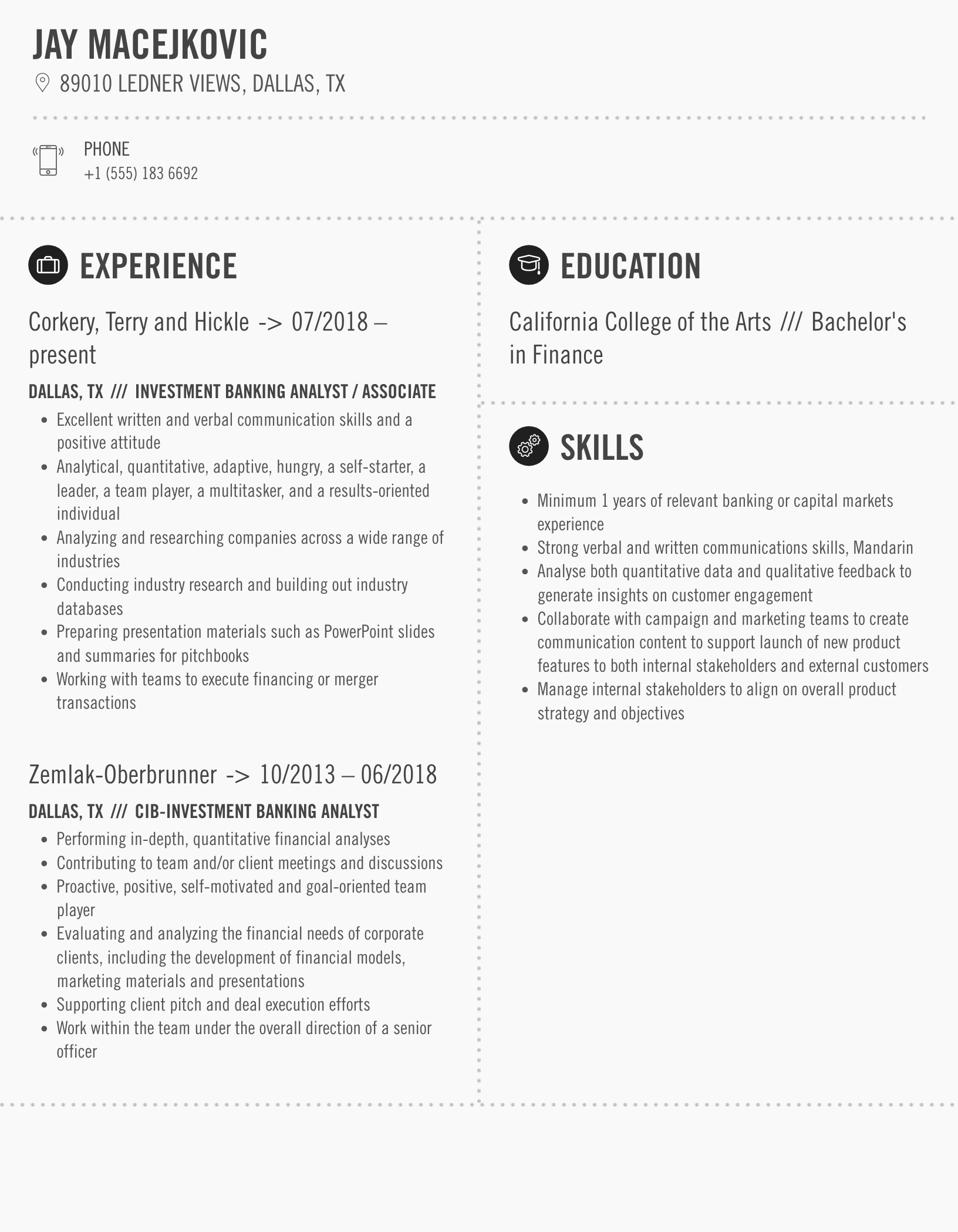

15 Investment Banking Analyst resume templates

Read our complete resume writing guides

1

Energy Investment Banking Analyst Resume Examples & Samples

- Assists in the publication of industry and company specific research

- Follows general current events in respective industry groups and keep bankers informed about critical issues in the news relevant to current and potential clients

- Maintains files related to active and prospective deals

- Maintains group databases - Deal Database and Weekly Status Reports

- Fundamental concepts, practices and procedures of Investment Banking

- Operating standard office equipments and using required software applications, including Microsoft Office and established databases

- Gather information, identify linkages and trends and apply findings to reports

2

Investment Banking Analyst Resume Examples & Samples

- Develops financial models to assess debt and equity financing alternatives for transactions

- Provides valuable input to equity offerings, valuations, private placements, mergers and acquisitions advisories

- Researches, analyzes, presents and documents drafting elements of a developing transaction

- Develops client presentations

- Problem solving skills and the ability to think independently sufficient to market ideas

- Remain cognizant of our commitment to daily workflow and regulatory compliance during high volume activity

- Bachelor's Degree (B.A.) in related field. Direct Investment Banking experience preferred

3

Investment Banking Analyst Consumer & Retail Resume Examples & Samples

- Work on multiple projects and transactions at any given time

- Play a critical role in supporting deal teams and processes from origination to close

- Participate in a broad array of corporate finance (debt, public and private equity) and advisory (M&A) assignments

- Prepare models, valuations and process / marketing support materials

- Participate in due diligence, drafting sessions and management meetings

- Minimum of 0-2 years post-undergraduate work experience in investment banking or a related field, preferably with a focus on the consumer and/or retail sector

- Must exercise good judgment in assessing risks and rewards of new business opportunities

- Excellent analytical, modeling and interpersonal skills

- Exposure to public financing and M&A transaction analytics and processes

4

Investment Banking Analyst Resume Examples & Samples

- Strong quantitative / analytical skills

- Disciplined work ethic

- Proficiency in Excel and PowerPoint

- Significant exposure to finance and accounting

- Experience with financial modeling and analysis preferred

- Highly-motivated, energetic

- MUST BE A 2015 GRADUATE

- Analyzing and researching companies in a wide range of industries

- Building financial models and performing in-depth quantitative financial analyses

- Contributing to team meetings and discussions

- Developing financial analyses and strategic presentations for clients

- Drafting offering memorandums for public or private financings

5

Transaction Advisory Services M&A Investment Banking Analyst Health Care Resume Examples & Samples

- A bachelor's degree and 1-2 years of health care investment banking experience

- An excellent working knowledge of Excel to develop financial models

- An efficient use of research databases

- Excellent interpersonal and relationship-building skills

- A dedication to teamwork

- The ability to manage multiple tasks simultaneously

- A willingness and ability to travel as necessary

6

Investment Banking Analyst, Richardson Barr Resume Examples & Samples

- Developing pitch book materials, financial models, and conducting company and industry research, and analyzing data to help advise our current or prospective corporate clients on actual or prospective acquisition & divestiture transactions and occasionally contribute to successful execution of corporate finance offerings

- Analytical, due diligence and transactional support on new business opportunities and acquisition & divestiture

- Other such duties, responsibilities and authority as may be reasonably required. JOB SPECIFICATIONS

- BA or equivalent with emphasis in finance/accounting

- Familiar with computer applications such as MS Powerpoint, Excel, Word, Access and Outlook

- Minimum of 6 (six) months of relevant Investment Banking or equivalent experience is preferred

- Familiarity with Aries/PhdWin and/or other industry reserves and economic software package is a plus

- LI-MH2

7

Investment Banking Analyst, Convertibles Resume Examples & Samples

- Previous experience in the ECM sector is highly desired

- Series 7 and Series 63 licenses preferred, but not required

- Outstanding quantitative and qualitative analytical skills; strong knowledge of finance and accounting

8

Investment Banking Analyst, High Yield Resume Examples & Samples

- Analytical, due diligence and transactional support on workout, restructuring, acquisition and new business opportunities

- Developing financial models, pitch book materials and conducting company research

- Previous experience in the High Yield sector is highly desired

- Excellent interpersonal skills with ability to maintain relationships at all level in organization

9

Investment Banking Analyst, Healthcare Resume Examples & Samples

- Some responsibilities include but are not limited to

- Analytical, due diligence and transactional support on workout, restructuring, LBO, acquisition and new business opportunities

- Developing financial models, pitch book materials and conducting company research, and analyzing data to help advise our current or prospective corporate clients on actual or prospective mergers & acquisition transactions and corporate finance offerings

- Assist in the structure of transactions involving Canadian Issuers in the US Market, including bond covenants

- Other such duties, responsibilities and authority as may be reasonably required

- Review and comply with Firm Policies applicable to your business activities

10

CIB Oil & Gas Investment Banking Analyst Calgary Resume Examples & Samples

- Creation of financial projections and merger models

- Learning and interacting with J.P. Morgan’s clients, products, services, and business practices

- Enrolment in or completion of the CFA designation or other professional designations (CA, P.Eng) is considered an asset

- Strong knowledge of corporate finance, accounting and financial modeling

- Strong analytical and quantitative skills

- Highly organized, detail oriented and proactive

- Preference will be given to candidates with previous industry and / or capital markets experience

11

Investment Banking Analyst, Technology Resume Examples & Samples

- Analytical, due diligence and transactional support on workout, restructuring, acquisition and new business opportunities

- Developing financial models, pitch book materials and conducting company research

- Analyzing data to help advise our current or prospective corporate clients on actual or prospective transactions

- Other such duties, responsibilities and authorities may be reasonably required

- Bachelor’s Degree required, preferably in finance, accounting, business or related field

- Solid understanding of capital markets and spreadsheet modeling

- Previous experience in the Technology sector is highly desired

- Minimum of 1 year experience in investment banking position

- Outstanding quantitative and qualitative analytical skills; strong knowledge of finance and accounting

- Highly motivated with demonstrated ability to manage conflicting priorities and requests

- Proficiency with personal computers and standard productivity applications

- Excellent interpersonal skills with ability to maintain relationships at all level in organization

- Ability to take initiative and function independently balanced with strong teaming skills

- Maintain high standards of professional and ethical conduct

12

Cib-investment Banking Analyst General Industrials Sydney Resume Examples & Samples

- Designing and implementing comprehensive M&A, debt and equity financing strategies for potential clients

- Supporting a deal or project team with analysis and research

- Performing financial valuations utilising discounted cash flow, leveraged buy-out and multiple based analyses

- Preparing presentation materials and participating in deal pitches

- Liaising with other internal and external parties on transactions

- Supporting due diligence & negotiations during transactions

- Marketing the full range of services to prospective and established clients

- Coordinating with product and industry groups to identify and exploit business opportunities

13

Investment Banking Analyst, West Coast Resume Examples & Samples

- Interest in developing a career in San Francisco

- Desire for a generalist experience during Analayst years with an emphasis on Financial Sponsor and Industrial clients

- Graduate from a topprogram or equivalent work experience

- Superior valuation skills

- Ability to learn quickly, with a particular focus on accounting rules and financial valuation methodologies

- Extraordinarily high level of focus on work quality and attention to detail

- Commercial instinct and ability to perform under pressure and tight deadlines -Demonstrated ability to work well in team environment

14

Investment Banking Analyst Resume Examples & Samples

- The analysts will support the team in

- Maintaining regular and frequent dialogue with product partners to assist with relationship maintenance

- Assisting in managing the Global Banking relationship infrastructure, including approvals and documentation

- Producing and updating client plans in conjunction with product partners and bankers

- Monitoring calling plans to ensure business development is pursued across the client base and that deals are replicated

- Collaborating with Global Portfolio Management to manage the portfolio and individual client risk

- Interacting with Citi’s network around the globe to ensure activities are co-ordinated across the franchise

- Collecting and analysing company information to assist with transactions including

- Conducting fundamental industry research

- Quantitative Analysis

- Reviewing and organising financial data

- Develop and update analyses to support marketing activity, and coordinate with bankers on delivery of project work

- Source and create pitch and marketing material, liaising with product partners and the Bankers

- Executing M&A, Capital raising or debt financing mandates on behalf of the client

- Managing due diligence effort

- Managing the transaction process (organisation of data room, Q&A sessions, etc)

- Analysing financial data, using and developing financial models including

- Stand-alone company valuations

- Discounted cash flow analysis

- Financing, comparative and pro-formal analyses

- Creating and finalising new business developments presentations

- Working with management on transaction terms

- Interacting with clients and various levels of management

- Pro activity - Identifying situations that could result in new business and developing recommendations tailored to the client

- Fluent in at least one Nordic language

- Investment Banking background gained from a reputable firm where you will have gained first class training and development as a banker

- Exceptional candidates who do not meet thesecriteria may be considered for the role provided they have the necessary skillsand experience

15

Investment Banking Analyst, ECM Resume Examples & Samples

- Analyzing data to help advise our current or prospective corporate clients on actual or prospective transactions

- Bachelor’s Degree required, preferably in finance, accounting, business or related field

- Ability to take initiative and function independently balanced with strong teaming skills

- LI-TL1

16

Global Investment Banking Analyst Program Resume Examples & Samples

- Develop and maintain complex financial models

- Perform various financial analyses, including valuations and merger consequences

- Conduct comprehensive and in-depth company and industry research

- Prepare presentation and other materials for clients

- Participate in due diligence sessions

- Communicate and interact with deal team members

- Manage several projects at once and work effectively as an individual and as part of a team

- A BA/BS degree from an accredited college oruniversity with a graduation time frame between December 2014 and June 2015 is required

17

Energy Sector Investment Banking Analyst Resume Examples & Samples

- Performs valuation methodologies comparative company analysis and discounted cash flow analysis on target companies

- Financial markets and products

- Analytical skills sufficient to assess and explain events in the market

- Assume full responsibility and accountability for own actions

- Demonstrate uncompromising adherence to ethical principles

- Be proactive and demonstrate readiness and ability to initiate action

- Bachelor’s Degree (B.A.) in related field

- Minimum of 1 year experience

18

Investment Banking Analyst, Leveraged Finance Resume Examples & Samples

- Analytical, due diligence and transactional support on workout, restructuring, LBO, acquisition and new business opportunities

- Developing financial models, pitch book materials and conducting company research, and analyzing data to help advise our current or prospective corporate clients on actual or prospective mergers & acquisition transactions and corporate finance offerings

- Other such duties, responsibilities and authority as may be reasonably required

- Review and comply with Firm Policies applicable to your business activities Escalate operational risk loss events, control deficiencies and risks that you identify to your line manager and the relevant risk and control functions promptly. JOB SPECIFICATIONS

- BA or equivalent with emphasis in finance/accounting

- Excellent written & verbal communication skills

- Familiar with computer applications such as MS Outlook, Word, and Excel

- Previous experience in Investment Banking is required, Leveraged Finance experience is highly desired

19

Investment Banking Analyst Resume Examples & Samples

- Comfortable reading and interpreting financial statements

- Commercial instinct and ability to perform under pressure and tight deadlines

- Interest in developing a career in investment banking in Calgary

- An MBA, CA and/or CFA designation would be an asset

- 3+years Investment Banking experience

20

Technology Investment Banking Analyst Resume Examples & Samples

- An undergraduate degree in finance or accounting

- Minimum of 0-2 years post-undergraduate work experience in investment banking or a related field, preferably with a focus on the Technology sector

- Ability to effectively manage multiple simultaneous project deadlines

- Proficiency in Excel and PowerPoint

- Excellent analytical, modeling and interpersonal skills

- Solid Work ethic and superior attention to detail

21

Investment Banking Analyst Resume Examples & Samples

- Contribute heavily with the oversight of an offshore processing team

- Detail oriented and very good problem solving skills

- Change management and process improvement mindset

- Experience in SOX testing or RCSA, not required, but a plus

- Able to multi task effectively

- High motivation and proactivity

22

Investment Banking Analyst Resume Examples & Samples

- Primarily involved in execution activities including basic responsibilities such as financial analysis, data gathering and material preparation as well as taking responsibility for managing standard processes such as preparing deal documentation

- Building and maintaining client relationships. Meeting the needs of internal and external clients with the highest quality products and services

- Work closely with colleagues on business prospects eg preparing pitch books, modelling potential deals, identify cross-product ideas, building effective cross-business relationships

- 1-3 years' experience gained from working in investment banking, accountancy, law, strategic consultancy or a similar financial services profession, with a track record of success, both academically and professionally

- Able to communicate clearly and work effectively as part of a team, you have strong financial analysis skills, impeccable attention to details and are committed to a career in investment banking

- You are a team player and able to work under pressure with the ability to produce presentational material and financial analysis quickly and accurately

23

Investment Banking Analyst, Leverage Finance Resume Examples & Samples

- Analytical, due diligence and transactional support on workout, restructuring, acquisition and new business opportunities

- Analyzing data to help advise our current or prospective corporate clients on actual or prospective transactions

- Other such duties, responsibilities and authorities may be reasonably required

- Highly motivated with demonstrated ability to manage conflicting priorities and requests

- Proficiency with personal computers and standard productivity applications

24

Investment Banking Analyst Resume Examples & Samples

- 1+ years of Mergers and Acquisitions experience

- Solid Investment Banking background

- Strong understanding of Financial Statements and Accounting concepts

- Technical proficiency in advanced Financial Analysis and Modeling (as well as MSOffice tools)

- Exceptional research skills

- Business Degree with significant Finance and/or Accounting coursework

25

Investment Banking Analyst / Associate Resume Examples & Samples

- 3+ years of prior work experience in Investment Banking or Capital Markets

- Strong understanding of various security types across the capital structure

- Solid analytical and technical skills

26

Investment Banking Analyst Resume Examples & Samples

- Other such duties, responsibilities and authorities may be reasonably required

- Solid understanding of capital markets and spreadsheet modeling

- Previous experience in the Leverage Finance sector is highly desired

- Minimum of 1 year experience in investment banking position

- Proficiency with personal computers and standard productivity applications

- Maintain high standards of professional and ethical conduct

27

Investment Banking Analyst Resume Examples & Samples

- 1-2 years of banking analyst experience

- Interest in working at a small firm

- One to two years of experience in finance and/or accounting

- Ability to work on several projects concurrently and possess the desire to learn quickly in a fast-paced and dynamic environment

- Strong analytical, interpersonal and communication skills

- Integrity, initiative, motivation, commitment and the ability to effectively work as part of a team

- Strong academic background and quantitative skills

- Candidates must be flexible, hardworking and detail oriented

- Intermediate to advanced abilities in Excel, PowerPoint, and Word

28

Investment Banking Analyst / Associate Resume Examples & Samples

- The Analyst/Associate will support the team in

- Maintaining regular and frequent dialogue with product partners to assist with relationship maintenance

- Assisting in managing the Global Banking relationship infrastructure, including approvals and documentation

- Producing and updating client plans in conjunction with product partners and bankers

- Monitoring calling plans to ensure business development is pursued across the client base and that deals are replicated

- Collaborating with Global Portfolio Management to manage the portfolio and individual client risk

- Interacting with Citi’s network around the globe to ensure activities are co-ordinated across the franchise

- Collecting and analysing company information to assist with transactions including

- Conducting fundamental industry research

- Reviewing and organising financial data

- Develop and update analyses to support marketing activity, and coordinate with bankers on delivery of project work

- Source and create pitch and marketing material, liaising with product partners and the Bankers

- Executing M&A, Capital raising or debt financing mandates on behalf of the client

- Managing due diligence effort

- Managing the transaction process (organisation of data room, Q&A sessions, etc)

- Analysing financial data, using and developing financial models including

- Stand-alone company valuations

- Discounted cash flow analysis

- Financing, comparative and pro-formal analyses

- Creating and finalising new business developments presentations

- Working with management on transaction terms

- Interacting with clients and various levels of management

- Knowledge of accounting and finance concepts

- Ability to conduct comparative and pro-forma financial analysis

- Knowledge of client planning and coordinating input from multiple product areas

- Organisational - Managing demands from several sources, working to deadlines and managing offsite analyst timetables

- Strong communication skills (both written & verbal) at all organisational levels - Attention to detail and clarity

- Pro activity - Identifying situations that could result in new business and developing recommendations tailored to the client

- Fluent in at least one Nordic language

- Educated to degree level with a minimum grade of 2:1 (or equivalent experience)

29

Investment Banking Analyst Industrials Group Resume Examples & Samples

- An undergraduate degree in finance or accounting

- Excellent analytical, modeling and interpersonal skills

- Solid Work ethic and superior attention to detail

30

Investment Banking Analyst, Leveraged Finance Resume Examples & Samples

- Developing financial models, pitch book materials and conducting company research

- Bachelor’s Degree required, preferably in finance, accounting, business or related field

- Solid understanding of capital markets and spreadsheet modeling

- Previous experience in the Leverage Finance sector is highly desired

- Minimum of 1 year experience in investment banking position

- Outstanding quantitative and qualitative analytical skills; strong knowledge of finance and accounting

- Ability to take initiative and function independently balanced with strong teaming skills

31

Investment Banking Analyst Campus Recruiting Coordinator Resume Examples & Samples

- Assisting the team in facilitating their daily responsibilities

- Assisting with IBD and cross-divisional internal and external events (i.e. presentations and interviews) and attending where appropriate

- Preparing and submitting Travel/Expense reports (as needed)

- Maintaining and updating the internal applicant tracking system (CRIS)

- Respond to students e-mails or questions as needed

- Develop and manage procedures to streamline the IBD recruiting process

32

Investment Banking Analyst Resume Examples & Samples

- 3+ years of experience in Sales, Trading, Marketing or Investments

- Bachelor’s Degree in Accounting, Finance and/or related field

- Basic understanding of accounting, corporate finance and company valuations

- Solid mathematical skills

- Bilingual (English and Japanese)

33

Investment Banking Analyst Resume Examples & Samples

- Primarily involved in execution activities, including basic responsibilities such as data gathering, analysis and material preparation, as well as taking responsibility for managing standard processes such as preparing deal documentation

- Has significant client contact and may act as the key point of contact for some clients in the context of a particular area of a transaction

- Develop relationships with peers in other organisations, including other advisors in order to develop market awareness and build a network

- Contribute to financial models

- Working knowledge of Corporate Client Solutions (CCS) products

- Establishes mathematical systems to accurately calculate record & monitor all existing & potential positions

- Develops understanding of particular financial market, equity or debt

- Applies research, business analysis & financial modelling skills

- May prepare detailed qualitative & quantitative reports on business sectors, companies & financial markets

- May develop financial models of markets & companies

- May prepare offering documentation for clients

- Ability to manage client relationships at the transaction level

- Working knowledge of the bank’s products and services

- Using relevant software packages, financial models and data manipulation packages

- Up-to-date knowledge of developments in own sector

34

Investment Banking Analyst Resume Examples & Samples

- Work with corporate finance investment bankers and product partners on M&A, strategic corporate finance, and capital raising transactions

- Perform financial modeling and valuation analyses on public and private companies: comparable company analysis, precedent transaction analysis, leveraged buy-out analysis and discounted cash flow analysis

- Develop marketing materials for topics such as company positioning, financing alternatives, and M&A/Strategic alternatives

- Develop knowledge of relevant information resources: Bloomberg, Capital IQ, Thomson Financial

- Series 79 & 63 (within 18 months of employment)

- Excellent organization, communication and research skills

- 1 - 3 years of experience in investment and/or commercial banking, leading accounting or consulting

35

Investment Banking Analyst, Real Estate Resume Examples & Samples

- Analytical, due diligence and transactional support on workout, restructuring, LBO, acquisition and new business opportunities

- Developing financial models, pitch book materials and conducting company research, and analyzing data to help advise our current or prospective corporate clients on actual or prospective mergers & acquisition transactions and corporate finance offerings

- Other such duties, responsibilities and authority as may be reasonably required

- Review and comply with Firm Policies applicable to your business activities

36

Investment Banking Analyst, Consumer & Retail Resume Examples & Samples

- Analytical, due diligence and transactional support on acquisitions, LBOs, equity and debt financings, restructuring, and new business opportunities

- Develop financial models, pitch book materials and conduct company research, and analyze data to help advise our current or prospective corporate clients on actual or prospective mergers & acquisition transactions and corporate finance offerings

- Other such duties, responsibilities and authority as may be required as necessary

- Proactively identify operational risks/ control deficiencies in the business

- Review and comply with Firm Policies applicable to your business activities

37

CIB Investment Banking Analyst Taiwan Resume Examples & Samples

- Utilising product expertise to meet client needs

- Building a strong network both internally and externally

- Mentoring of junior bankers

- Liaising with other internal and external parties on transactions (eg. lawyers, accountants, other banks)

- Day to day management of transaction workstreams

- Proven track record in corporate finance transactions

- Minimum 5 years proven experience in finance or law

- Strong technical and valuation skills

- Excellent product / sector knowledge and expertise

- Relevant tertiary qualification or equivalent experience (degree in finance, economics, accounting, law etc)

38

Investment Banking Analyst Resume Examples & Samples

- Work with corporate finance investment bankers and product partners on M&A, strategic corporate finance, and capital raising transactions in the Technology sector

- Develop marketing materials for topics such as company positioning, financing alternatives, and M&A strategic alternatives

- Develop knowledge of relevant information resources: Bloomberg, Capital IQ, Thomson Financial, etc

- Highly motivated and talented individual with the desire for a career in Investment Banking or Capital Markets

- Demonstrated interest in corporate finance, investment banking, accounting, and financial markets

- Strong academic track record with coursework completed in the areas of Economics, Accounting and Finance

- Proven research skills and possessing the ability to succinctly express ideas

- Strong team player with a positive "can-do" attitude and desire to be part of a close-knit group operating in an intensive and challenging work environment

- 1-3 years of relative work experience

39

Investment Banking Analyst Resume Examples & Samples

- Supports senior managers in origination activities including (but not limited to): preparing historical and projected financial statements, provide analysis of financial implications of mergers and acquisitions and conducting public & private valuation analysis for major corporations

- Involved in execution activities, including basic responsibilities such as data gathering, analysis and material preparation, as well as taking responsibility for managing standard processes such as preparing deal documentation

- Builds and applies valuation models based on financial research & analysis including comparable company analysis, discounted cash flow analysis and comparable acquisitions analysis

- Prepares analytical materials to support necessary credit, compliance, engagement committee and balance sheet approvals

- Conducts corporate operations reviews, portfolio analytic reviews and prepare risk/return valuations

- Gathers and processes market share data and shareholder and investor profiles

- Results driven and able to perform well under pressure and against tight deadlines

- Strong analytical and numerical skills that put you at ease with financial data

- At least 2 years’ experience within Mergers and Acquisitions in the Energy and Chemicals sector

- Strong Microsoft Office suite (Excel a must) and financial reporting skills

40

Investment Banking Analyst Resume Examples & Samples

- Deal execution, including documentation, data gathering, analysis and material preparation

- Management of client relationships and may act as the key point of contact for some clients in the context of a particular area of a transaction

- Supporting senior managers in origination activities (e.g. preparing pitch books or modeling potential deals)

- Developing relationships with peers in other organisations, including other advisors in order to develop market awareness and build a network

- Contributing to and taking primary responsibility for financial models with oversight from more senior team members

- Developing working knowledge of UBS investment banking products

- Developing understanding of particular financial markets and products

- Applying research, business analysis & financial modelling skills

- Preparing detailed qualitative & quantitative reports on business sectors, companies & financial markets

- Preparing offer documentation for clients

- Helping to prepare presentation materials

- Maintaining up-to-date knowledge of developments in own sector

41

Investment Banking Analyst Capital Markets Resume Examples & Samples

- Researches and creates pitch materials, performs valuation analyses, and researches companies and industries on behalf of Senior Bankers as well as on own projects

- Participates in merger & acquisition transaction execution, including financial analysis, model creation, drafting memoranda, due diligence, attending client meetings, interacting with prospective buyers, creating and managing data rooms, and any other duties required to support executing an engagement

- Researches, identifies and develops regular dialogue with key investors and buyers

- Partners with senior bankers in developing strategic dialogue with clients and prospects

- This position will regularly require extended working hours and weekend work may periodically be required as well

- Other duties may be assigned

- 20150529

42

Investment Banking Analyst Resume Examples & Samples

- Assist in the preparation of financial projections to support investment banking engagements, including: financial modeling; comparable company transaction multiple or deal structure analyses to support deal positioning, negotiation and execution

- Assist in the preparation of memoranda, presentation materials, and marketing materials

- Facilitate research projects that underpin transaction positioning and recommendations to enhance

- Bachelor s degree in business, accounting or finance or in lieu of a bachelor’s degree, four years relevant work experience

- Sound knowledge of Windows and PC software programs

- Proficiency of spreadsheets, graphing, and presentations with a basic knowledge of financial models using Excel

- Prior relevant experience in investment banking

- Excellent oral and written communication and presentation skills

- Strong interpersonal skills with the ability to interact with all levels of personnel

43

Investment Banking Analyst / Associate Resume Examples & Samples

- Prior experience in an investment bank with a track record in M&A and capital markets transactions is essential

- Ability to excel in both team and self-directed settings

- Strong work ethics, detail orientation and a passion for excellence

- Ability to deliver under time pressure

44

Investment Banking Analyst Resume Examples & Samples

- Work directly with the group’s senior professionals and be involved in all aspects of SPO transactions across a variety of non-traditional asset classes (no sector specialization)

- Prepare marketing presentations, term sheets, and rating agency materials

- Model securitization transactions backed by various types of esoteric assets

- Run cash flow scenario analyses for investors and issuers

- Tie out the models and collateral characteristics with accountants, Intex and other parties

- At least one, but no more than three years of work experience

- Familiarity with legal documents a plus

45

Investment Banking Analyst Resume Examples & Samples

- Analyze potential merger, acquisition, financing, and other client transactions, including significant financial modeling responsibilities

- Create client and investor presentations

- Participate in all aspects of deal execution, including both client-facing and internal responsibilities

- Work closely with senior bankers to help guide clients in their financial decisions

46

Power & Utilities, Investment Banking Analyst Resume Examples & Samples

- Assist in developing proposals to clients and potential clients for equity and debt placements, mergers, divestitures, acquisitions, and advisory assignments

- Conduct industry research and analysis to assist in the identification and/or analysis of potential or actual business opportunities

- Develop financial models, determining the assumptions and methodology

- Liaise with other units of CIBC World Markets in preparing proposals for clients

- Prepare industry and financial analysis to determine the feasibility of potential financing and M&A transactions

- Perform industry comparative analysis

- Assisting in due diligence

- Preparation of offering memorandums and marketing materials

- Prospectus drafting

- Ensures that recommendation and opinions offered to clients are in compliance with legislation and at all times maintains the professional standards and policies of CIBC

- Successful candidates must exhibit CIBC’s values of trust, team work, and accountability

- Must have a relevant undergraduate degree

- Previous corporate finance/investment banking experience is an asset

- Excellent analytical ability including demonstrated knowledge of valuation techniques and practices, specifically related to the power & utilities industry

- Knowledge of accounting principles relating to financial statement preparation and business combinations

- Extremely dedicated and motivated individual with high career aspirations. Must be capable of assuming significantly increased levels of responsibility within short time frames

- Excellent interpersonal and presentation, oral and written communication skills, to actively participate in developing and maintaining productive client relationships

- Demonstrated job commitment including a willingness to work, as well as personal flexibility and adaptability in order to meet client requirements

- Superior Excel, Word, PowerPoint and Bloomberg skills

47

Investment Banking Analyst Resume Examples & Samples

- Direct many aspects of day-to-day project execution and origination

- Assist and supervise in the preparation of presentation materials, including equity market update materials, pitch materials, transaction structuring and pricing information

- Significant responsibility for identifying client needs and shaping client presentations

- Assist and supervise in the preparation of execution related documents such as briefing sheets, allocation letters, settlement schedules, underwriting agreements, pricing papers

- Responsibility for managing / supervising bookbuilds and allocations (eg. via DealAxis)

- Significant client interaction at most levels

- Assist bankers with offering memorandums and review of related documents

- Liaise with other internal and external parties on transactions (eg. sector investment bankers, equities sales force, research analysts, lawyers, compliance, accountants, other banks etc)

- Growing understanding of how the firm's full range of products and services can add value in different situations

- Technical and valuation skills and ability to critique other team members' analysis

- Solid business and market judgement

- Ability to prioritise business opportunities and formulate recommendations

- Accountability: ability to tie big picture view of the markets to the identification of opportunities to issuers of equity

- Clear thinking and concise communication

- Ability to successfully prioritise and deliver competing requirements

- Ability to demonstrate utmost discretion and professionalism at all times

- Leadership, planning and ability to manage a multitude of responsibilities

48

Investment Banking Analyst, Frankfurt Resume Examples & Samples

- Candidate must have completed an undergraduate degree

- Current experience as an investment banking Analyst (or related financial position) and up at least one year relevant experience in same/similar job

- Strong quantitative and technical abilities incl. financial modeling and accounting

- An outstanding academic record

- Robust financial and analytical skill set

- Fluent German and English language skills

49

Investment Banking, Analyst Resume Examples & Samples

- An undergraduate degree with academic coursework in finance, economics, or accounting and an outstanding academic achievement

- 0 - 3 years of successive relevant experience within investment and/or corporate banking experience based on business requirements

- Previous industry experience within the energy sector (oil & gas, power, energy infrastructure)

- Expertise in financial computer applications and database management tools including MS Excel. Strong proficiency in other Microsoft Office products and the Internet

- Strong interpersonal skills used within a demanding team environment

50

Investment Banking Analyst Resume Examples & Samples

- Build detailed financial models to evaluate performance under various operating scenarios and to analyze the impacts of different capital structures and potential M&A transactions

- Participate in drafting prospectuses and marketing presentations for transactions

- Preparing client presentations (including compiling data and assembling presentation materials)

- A clearly defined interest in Investment Banking and M&A

- The ability to manage multiple projects simultaneously while maintaining a high standard of work

- The ability to perform effectively in a team environment

51

Investment Banking Analyst / Associate Resume Examples & Samples

- Building detailed financial models and performing financial and valuation analyses and preparing presentation materials

- Participate in all stages of transaction executions, from the pitch phase through to closing

- Involved in day to day project management and execution support

- Prior experience in an investment bank (or Big 4 advisory team) with some track record in M&A transactions is essential

- Strong analytical and modeling skills is the most important criteria and is must

- Strong work ethics, attention to detail and strong accounting concepts is must

52

Investment Banking Analyst Resume Examples & Samples

- Collaborate with the team to support senior members in deal origination and execution

- Create pitch books and other presentation materials, cover market research and perform due diligence

- Support senior team members with project management

- 3+ years of IBD experience at a Japanese or international investment bank

- Solid understanding of transaction cycle

- Knowledge of risk management

- Finance/Accounting background

53

Investment Banking Analyst Resume Examples & Samples

- The analyst works closely with senior members of the team in support of its origination and execution activities. The analyst will assume lead responsibility for financial modeling, preparation of presentations, research and certain administrative functions

- Supporting the senior team members in the day-to-day information flow with clients and third-parties in a transaction execution setting

- Preparation of financial models, projections, and merger analyses

- Preparation of marketing presentations

- Other financial analysis including the financial capacity of potential acquirers or competitors for an asset

- Analyzing transaction and trading comparables of companies in similar sectors and current market valuation trends

- Organizing due diligence information that is used by potential acquirers in their review of potential transactions

- Both on the marketing and the execution side, our analysts are involved in a number of activities in support of the Managing Directors and other senior members of the group

- This position is in Boston

- Undergraduate degree with a concentration in finance or related studies

- Strong undergraduate records

- Proficiency in Microsoft Excel, PowerPoint and Word

54

Investment Banking Analyst Resume Examples & Samples

- 1+ year of experience from an Investment Banking or Public Accounting firm (Audit and Advisory)

- Microsoft Excel proficient (Pivot tables, V-Look Ups, Macros, etc.)

- Experience with and working knowledge of SQL, VBA, and Python

55

Investment Banking, Analyst, Dubai Office Resume Examples & Samples

- Candidate must have completed an undergraduate degree

- Strong quantitative and technical abilities

- Personal integrity, initiative and leadership qualities

- Strong communications, multi-tasking and time management skills

56

Cib-global Investment Bank Investment Banking Analyst Resume Examples & Samples

- Work as a part of the deal team to support seniors in deal origination and execution. Contribute to the production of presentation materials, prepare transaction documents, conduct due diligence and perform market research

- Develop and sensitise financial models

- Provide project management support to senior team members

- Corporate Finance Analyst with strong accounting, finance, quantitative and business writing skills

- Have prior working experience in an investment banking front office

- Understands the different types of risk and can discuss in detail ways of managing these risks

57

Investment Banking Analyst Resume Examples & Samples

- Manage and assist in M&A and financing transactions, financial modeling, industry and comparable company analysis

- Document and support the execution of new financing issues for corporate clients

- Develop pitchbooks and related client materials

- Prepare and deliver client presentations in a clear and compelling manner

58

Investment Banking Analyst Resume Examples & Samples

- Analysts will work closely with senior team members to execute a variety of corporate finance transactions across multiple industry sectors

- Conduct research and prepare analyses of companies, industries, capital markets, historical financial statements and prospective financial information

- Create and author financial models, valuation analysis, debt capacity, capital adequacy, analyses and documents, as well as presentations for proposals and transactions

- Identify financing alternatives, capital sources, strategic and financial buyers

- Manage due diligence and client relationships at appropriate levels

59

Investment Banking Analyst Resume Examples & Samples

- Detailed, complex financial modeling

- Company and security valuation

- Financial performance and sensitivity analysis

- Corporate and industry research

- Transaction due diligence

- Preparation of marketing and presentation materials

- Management presentations and offering memorandums

- 2-3 years Investment Banking (M&A or Corporate Finance) Experience

- Proficient in Financial Modeling, including DCF, LBO, Merger and Accretion/Dilution

- Proficient in building Pitchbook presentations

- Possesses a succinct understanding of the salient points of a deal

- Does not require technical teaching or coaching - Demonstrates autonomy & reliability above experience level

- Strong Academic performance - 3.5+ GPA, BS in Finance or Related Major

- Hard-working, perfectionist, outgoing and sociable

60

Investment Banking Analyst Resume Examples & Samples

- Creating financial analysis and strategic business analysis

- Stay abreast of industry trends and best practices of clients’ competitors

- Tracking business development (collect research, analyze industry trends)

- Ability to identify new business opportunities and suggest solutions

- Evaluate corporate transactions and their structures

- 1-2 years’ or more of investment banking experience at a recognized investment bank although we will also consider those with industry experience in a relevant corporate or Big 4 accounting firm

- Superior analytical, quantitative and financial modeling skills

- Fluent in accounting and finance with deep knowledge of Investment Banking methodologies

- Ability to think strategically and creatively identify industry trends and provide strategic insight

- Ability to exercise judgment, prioritize tasks and work on multiple engagements

- Team player with high integrity and self-motivation

- Ambition, motivation and drive to succeed in a fast-paced, global institution and leverage the franchise to deliver superior results to the firm

- Superior client interaction skills and commitment to serving the client

61

Energy Investment Banking Analyst Resume Examples & Samples

- Preparation of client presentation materials including M&A profiles and analysis, financial statement and capital markets analysis, case studies and valuation analysis

- Monitors the analytical performance of publicly traded client companies

- Maintenance of financial and transactional databases

- May be involved in all aspects of originating and executing client transactions, from pitch to closing with specific tasks to include financial modeling and analysis, drafting of offering documents, conducting due diligence and marketing of transactions

- Responsibility for the quantitative financial analysis and qualitative document issues related to the execution of M&A, A&D and capital markets transactions for clients

- Works with senior investment bankers

- Assumes responsibility for day-to-day deal activities

- This job interfaces with senior investment bankers

- This job must effectively foster client relationships

- Analyst position does not require prior investment banking or energy experience, although candidates should process strong knowledge of the financial markets and valuation analysis

- Associate position requires prior investment banking experience and/or familiarity with the energy industry

- Excellent analytical ability including demonstrated knowledge of valuation techniques and practices, including cash-flow analysis

- Excellent interpersonal and presentation skills, to actively participate in developing and maintaining productive client relationships

- Well-developed organizational skills in order to respond to shifting priorities on several simultaneous projects

- Excellent interpersonal, presentation, oral and written communication skills in order to convey factual and conceptual information to others and promote the interests of CIBC World Markets

62

Experienced Investment Banking Analyst Resume Examples & Samples

- Minimum one year of Investment Banking or related financial experience

- Bachelor’s degree from a top tier business school

- Ability to work in a fast paced and challenging environment

- Candidates must be able to handle multiple projects at once and learn quickly

- Previous experience with financial modeling or formal training

63

Public Finance Investment Banking Analyst Resume Examples & Samples

- Preparing analyses on client capital structure, debt capacity and credit profile

- Drafting responses to request for proposals by clients

- Interacting with internal and external financing team members in developing, executing and closing of a transaction

- B.S. or B.A. with major(s) in business, economics, public administration or related fields is preferred

- Successful candidates will be highly self-motivated and willing to work long hours when needed

- Excellent analytical and quantitative skills are a must and good understanding of financial markets is expected

- Well organized, attention to detail and able to manage multiple projects under pressure

- LI-KF1

64

Cib-investment Banking Analyst Resume Examples & Samples

- Working as a part of the deal team to support seniors in deal origination and execution

- Contributing to the production of presentation materials, prepare transaction documents, conduct due diligence and perform market and industry research

- Performing financial valuation, discounted cash flow and multiples based analyses

- Executing client transactions from start to closing

- Providing project management support to senior team members

- Applying the firm's approach and policies for managing risks

- Prior working experience in an investment banking front office role

65

Investment Banking Analyst Resume Examples & Samples

- Minimum of 0-2 years post-undergraduate work experience in investment banking or a related field, preferably with a focus on the Technology sector

- Must exercise good judgment in assessing risks and rewards of new business opportunities

- Strong ability to work in an entrepreneurial culture

66

Investment Banking Analyst Resume Examples & Samples

- 3+ years of Accounting and/or Finance experience

- Bachelor's Degree in Accounting, Economics, Engineering, Finance, Mathematics, and/or a related field

- Experience with Cash Flows, Mergers and Acquisitions, and Valuations

- Previous experience in the Banking industry

- Microsoft Office/Suite proficient (Excel, PowerPoint, and Word)

67

Experienced Investment Banking Analyst Resume Examples & Samples

- Provide analytical support on mergers and acquisitions, public offerings and other financial advisory services for our clients

- Assist in the preparation of company valuations, financial models, company marketing documents and client presentations

- Perform research and various analyses in support of new business generation

68

Investment Banking Analyst Resume Examples & Samples

- Facilitate research projects that underpin transaction positioning and recommendations to enhance shareholder value

- Coordinate and carryout routine operational tasks that arise on a day-to-day basis

- Maintain financing source, investor or client databases to create efficiencies in the deal marketing and execution process and other databases used in the deal marketing and execution process

- Assist in the identification of deal-appropriate investors, participating in the marketing of deals

- Manage business unit projects that arise from time to time

- Maintain appropriate records to ensure compliance with regulatory requirements

- Bachelor s degree or in lieu of a bachelor’s degree, four years of relevant work experience

- Proficiency of spreadsheets, graphing, and presentations with a basic knowledge of financial models

- Must possess solid analytical, written and verbal skills as well as demonstrated ability to work in a team oriented environment

- Degree in accounting or finance concentration

- Series 7 or 79

69

Investment Banking Analyst Power & Utilities Resume Examples & Samples

- Minimum one year of investment banking work experience preferred

- Proven record of outstanding achievement in academic and extracurricular activities

- A high level of attention to detail

- Demonstrated ability to quickly adapt to new situations

- A high level of energy and a keen desire to learn new concepts

70

Investment Banking Analyst Resume Examples & Samples

- Actively participating in restructuring assignments, a high pressure environment that requires an ability to quickly and accurately respond to requests

- Preparing valuations (i.e. comparable analysis, DCF, etc.)

- Providing a high level of qualitative and quantitative financial modeling

- Ensuring that all material is accurate and complete

- Participating actively in client meetings

- Preparing pitch books to support the group's ongoing business development efforts

- Conducting business, industry, and capital markets research

71

Investment Banking Analyst Resume Examples & Samples

- Financial Analysis - Conduct financial analysis, financial modeling, structuring, and capital structure analysis for various issuers of corporate debt and private equity

- Conducting Due Diligence - Assess information required to perform all pertinent analyses and to compose transaction-related documents; compile information request lists and track the information gathered; assist investors in their due diligence process

- Conduct Research - Research current and prospective client companies, comparable companies and transactions, and industries; monitor and research capital markets; update client and debt/equity databases

- Drafting Transaction-Related Documents - Draft offering memorandums, road-show presentations, and other communications with clients and investors

- Preparing Client Proposals and Presentations - Compile and prepare appropriate marketing materials, conduct the necessary analysis, and incorporate the assembled information into client proposals; supervise production and distribution

- Also, prepare and supervise external marketing initiatives Participate in other projects as requested by management

72

Investment Banking Analyst Resume Examples & Samples

- Monitor the macroeconomic environment and issuance activity in the equity capital markets

- Develop pitch materials with industry investment banking colleagues for public and private companies seeking equity capital solutions

- Interface with the institutional sales and equity research teams on transaction execution

- Work directly with senior management to create industry analyses for strategic planning

- Conduct and maintain internal accounting processes and forecasts for the ECM group

- Have direct interaction with client management teams

- Bachelor’s degree in business, accounting, finance, mathematics or economics is required

- 1 – 2 years of experience in the financial industry or in a finance-related role is preferred

- Experience with Microsoft Word, Excel, and PowerPoint is required. Familiarity with VBA, Hyperion, and Microsoft Access are a plus

- The ability to create innovative solutions, articulate complex ideas and adapt to a rapidly changing environment is essential

- Analysts must be able to work well under pressure and manage multiple time-sensitive projects and tasks

- LI-MH2

73

Investment Banking Analyst Resume Examples & Samples

- Monitoring markets to determine indicative pricing levels for various products

- Analyzing trends in the markets, including macro-environment and new issue/secondary

- Ability to provide modeling and valuation analysis for all transactions

- Supporting deal teams on all parts of transaction execution

- Chaperoned communication with research on pricing and structuring of mandated IPOs

- Collaborating with equity sales to gather investor feedback on live transactions

- Analyzing current shareholder trends and peer ownership changes

- Understanding of financial concepts and the securities markets

- Solid work ethic and superior attention to detail

- Strong ability to work in a team-based and entrepreneurial culture

74

Investment Banking Analyst Leveraged Finance Resume Examples & Samples

- Conducting financial analysis, financial modeling, structuring, and capital structure analysis for various issuers of corporate debt and private equity

- Assessing information required to perform all pertinent analyses and to compose transaction-related documents; compile information request lists and track the information gathered; assist investors in their due diligence process

- Research current and prospective client companies, comparable companies and transactions, and industries; monitor and research capital markets; update client and debt/equity databases

- Draft offering memorandums, road-show presentations, and other communications with clients and investors

- Compile and prepare appropriate marketing materials, conduct the necessary analysis, and incorporate the assembled information into client proposals; supervise production and distribution. Also, prepare and supervise external marketing initiatives

- Minimum of one year of experience as an Analyst in leveraged lending and/or high yield financing

- Strong financial modeling skills required. Build detailed, fully-integrated financial models to construct financial projections and test their feasibility, analyze the impact of proposed transactions on capital structures, cash flows, debt service requirements, compliance with and financial covenants, and differences in GAAP and tax treatments, etc

- Experience analyzing financial statements and related data to assess historical financial performance and future outlook for client companies and prospects

- Ability to manage expectations of senior bankers, other deal team member.s and clients while working on multiple projects simultaneously

75

Corporate Investment Banking Analyst Resume Examples & Samples

- Bachelor’s Degree in Economics, Business or related area required from an accredited college or university

- MBA or Masters Degree preferred

- 0-3 years of prior experience working as an analyst or intern for an investment or global corporate bank

- Ability to multitask and work under pressure.,Ability to work independently and function within a team

- Basic Knowledge of financial data sources (Capital IQ and Bloomberg preferred)

- Basic understanding of Banking, Financial principals, and Capital Markets

- Expertise with Excel and exceptional PowerPoint presentation capabilities

- Strong communication skills (Fluency in Spanish is strongly preferred)

- Strong critical thinking, interpersonal, analytical and communication skills,

- Must be particularly well-organized, responsible and capable of delivering requests on time

76

Investment Banking Analyst Resume Examples & Samples

- Play a critical role on deal teams; helping to manage the deal process from origination to execution

- Involved in both corporate finance (debt, public and private equity) and M&A

- Deeply involved in the analytical product created for clients

- Students graduating in May/June 2017 will not be considered

- At least 1 year of full-time work experience in investment banking or in the Oil & Gas industry

- Bachelor’s degree in a business-related field; prefer degree to be in Finance or Accounting

- Strong skills and experience in analyzing businesses and their financials supported by deep knowledge of accounting

- Must be capable of producing high quality work products independently and as part of a collegial team

- Excellent communication skills (both in written materials and verbally)

- Ability to work in an entrepreneurial culture

- Demonstrated problem solving abilities and judgment

77

Investment Banking Analyst Resume Examples & Samples

- Interest in developing a career in investment banking

- Series licensing or must obtain

- 1-2 years of experience in Oil and Gas Investment Banking

- Interest in Natural Resources

78

Corporate & Investment Banking Analyst Summer Internship Resume Examples & Samples

- Understand and download data from various bank systems

- Interpret and save data from market data systems as Bloomberg or S&P Capital IQ

- Work and increase connectivity with other Geographies

- Collaborate and liaise with GCB business development team

- Microsoft Excel and Power Point proficient with a high level of analytical skill, professional confidence, and presentation skills

79

Corporate & Investment Banking Analyst Fall Co-op Resume Examples & Samples

- Interpret and save data from market data systems as Bloomberg, internal Bank systems, S&P and Capital IQ

- Support Associates, VPs and Bankers in preparing pitch book materials for clients and internal presentations

- Monitor and track pipeline activity and forecasting for general purposes

- Collaborate and liaise with Product, Legal and Compliance teams

- Understanding of financial statements and corporate credit

- Must be enrolled as an undergraduate student

- Previous experience through internships in banking or finance is a plus

- Major in Finance, Engineering or Math preferred

- Microsoft Excel and Power Point proficient

80

Investment Banking Analyst Resume Examples & Samples

- Complex financial modeling of financial solutions including structured debt, lease and equity investments

- Assisting in the underwriting, credit risk analysis, negotiation, and closing of new transactions and/or amendments of existing transactions

- Assisting with legal documentation matters

- Participation in client meetings to develop a deeper understanding of the client's business, management team, and past and future performance

- Exceptional analytical skills with attention to detail

- Strong interpersonal skills, flexibility and ability to work well in teams

- Disciplined work ethic, organized, self-motivated and solid time management skills

- Computer literacy including proficiency with Microsoft Excel, Word and PowerPoint

- Able to furnish proof of citizenship, permanent residency or authorization to work in the U.S

81

Investment Banking Analyst Resume Examples & Samples

- Assist managing directors with projects resulting from their coverage responsibilities

- Collect and analyze data related to trends within the private equity community

- Conduct industry and company-specific research; develop ideas for private equity clients

- Streamline internal CRM tool allowing for greater use of internal data via custom reports

- Oversee the development of the group’s marketing materials

- Manage overall sponsor-related red zone targeting

- Coordinate and respond to industry and product banker requests

- Interact with private equity clients

82

Investment Banking Analyst Resume Examples & Samples

- Working on both origination (pitching) and executions – live mandates within the Consumer Products and Retail sector

- Analysis of financial information, creating financial models, both operational and valuation (DCF, trading and transaction comparables, Accretion Dilution, LBO)

- Developing pitch book presentations along with the team

- Developing an understanding of the sector and key trends and idea generation with respect to opportunities within the sector

- Coordinating with global (regional) and product coverage teams on a frequent basis

- Maintaining team infrastructure to best practice standards

83

Investment Banking Analyst, Power & Mining Resume Examples & Samples

- Evaluating and analyzing the financial needs of corporate clients, including the development of financial models

- Preparing marketing materials and presentations

- Financial and written analysis of companies and industries

- Drafting prospectuses and marketing presentations for transactions

- A clearly defined interest in Investment Banking

- A strong sense of personal integrity

- Independent thinker and proven ability to make decisions

- Related industry experience is an asset

84

Investment Banking Analyst Resume Examples & Samples

- Analyzing public and private company financial statements

- Maintaining various company and industry related databases

- Performing detailed financial modeling and valuation analysis

- Preparing presentations, materials and pitchbooks to clients

- Supporting transaction teams in the execution of financing and advisory assignments

- Other ad-hoc tasks as required

- Undergraduate degree with a focus in a business, finance, accounting or related discipline

- Previous investment banking experience an asset

- Less than two years of professional work experience

- Demonstrated strong interest in capital markets

- Hardworking with strong teamwork and verbal/written communication skills

- High level of attention to detail and strong time management ability

- High level of proficiency with PowerPoint and Excel

85

CIB Investment Banking Analyst / Associate Resume Examples & Samples

- Maintain dialogue with clients and build relationships

- Presentation of origination ideas and transaction related materials to clients and other advisors

- Responsibility for developing solutions for clients and oversight of pitchbooks

- Involvement in recruiting

- Previous experience in Investment Banking or Private Equity in an international environment is required

- Demonstrate transaction expertise and command of underlying technical skills required

- Language skills: fluency in Italian and English required

- Strong financial modelling and technical skills

- Understanding and appreciation of investment banking products

- Strong attention to detail and quality-control focus

- Management of internal conflicts, commitments and engagement processes

- Strong project management and multi-tasking skills

- Ability to work efficiently and diligently against stringent time deadlines

- Ability to cope and manage transaction execution under pressure

- Strong management skills enabling candidate to effectively manage more junior bankers in high pressure environment

- Ability to multi-task and delegate appropriately

- Ability to engage and interact with senior bankers and clients

- Understanding and awareness of financial, legal and reputational risks facing large integrated investment banks today

86

Investment Banking Analyst Resume Examples & Samples

- Support senior bankers in researching and creating marketing pitch

- Materials, building financial models to value potential clients, and researching industries or sectors as determined by senior bankers in targeting certain clients or industries

- Assist in active equity and merger and acquisition transaction execution

- Including, but not limited to: financial analysis, model creation, drafting memoranda, due diligence, attending client meetings and drafting sessions, creating data rooms, and any other support services required to assist in closing an engagement

- Travel to client meetings, drafting sessions, road show stops and due diligence as necessary

- Participate in any other requests from senior bankers or clients

- Strong financial modeling skills required. Build detailed, fully-integrated financial models to construct financial projections and test their feasibility, analyze the impact of proposed transactions on capital structures, cash flows, debt service requirements, compliance with and financial covenants, and differences in GAAP and tax treatments, etc

- Experience analyzing financial statements and related data to assess historical financial performance and future outlook for client companies and prospects

- Series 79 and 63 licenses required within 90 days of hire

- Committed to satisfying internal and external customers

- Ability to manage expectations of senior bankers, other deal team member.s and clients while working on multiple projects simultaneously

- Excellent mathematical, writing, verbal and computer skills

87

Cib-investment Banking Analyst Resume Examples & Samples

- Using in-depth analysis to generate business ideas and recommendations

- Utilizing product expertise to meet client needs

- Editing and refining marketing/execution materials for maximum client impact

- Conducting due diligence

- Day to day management of transaction work streams

- Strong project management capability

88

Investment Banking Analyst Resume Examples & Samples

- Research, analyze and document qualitative and quantitative trends in target industry sectors

- Analyze capital markets and mergers and acquisitions activity in target sectors

- Identify and research companies in target industry sectors with a history of acquisitions, including their current strategic objectives

- Assist senior and junior investment bankers with the M&A transaction process

- Assist in producing monthly industry and market reports

- Support and assist the due diligence effort for both buyers and sellers

- Assist in organizing the operations of a transaction closing

- Create buyer and/or target lists

- Build financial models for use in transactions

- Bachelor's degree required, emphasis in Accounting or Finance preferred

- Minimum of 1 year of experience with a financial services firm required, investment banking firm experience preferred

- Will possess an ability to analyze a business situation using financial models